Table of Contents Show

- Predictable Cash Flow

- Tax Breaks and Deductions

- You Can Build Equity

- Your Real Estate Will Rise in Value Over Time.

- You Can Diversify Your Portfolio

- You Can Take Advantage of Inflation Hedging

- Real Estate Investment Trusts (REITs)

- Rental Income Can Pay for Many Things

- Investing is Good for the Local Economy

- Real Estate Investing Can Eventually Lead to Owning Your Dream Home

- Final Thoughts

Becoming a real estate investor can feel like a dream for many people. You enjoy predictable cash flows, tax advantages, diversification, and maybe even build enough wealth to retire early. Yet many of these people are convinced it is a pipedream and not reachable for “normal people.” You don’t need to have tons of money or be the next Warren Buffet to start real estate investing. Anyone can do it; all a matter of assessing your finances, determining what you can afford, and going from there. Start small and build big.

There are many other reasons to get started today. Becoming a real estate investor comes with many benefits besides easy cash flow. Here are ten of the biggest ones.

Predictable Cash FlowPredictable Cash Flow

The most obvious is predictable cash flow. Cash flow is your net income after mortgage payments and operating expenses are deducted. Unlike other investments, you can easily predict how much income you’ll generate from your real estate investments per month and annually. Based on the market, you set the price for the rent, and so long as you can always keep it occupied, you can start getting immediate returns on it. Just make sure to budget for routine maintenance and annual expenses.

Tax Breaks and DeductionsTax Breaks and Deductions

Real estate comes with numerous tax breaks and deductions that you won’t get with other investments. For your own home, you can deduct mortgage interest. State and local taxes are also usually deductible. You can deduct operating expenses, insurance, property taxes, and maintenance for investment properties. If you sell your property, your capital gains tax can be 15% to 20%, far lower than your typical personal income bracket. Plus, you can defer capital gains if you use your income from the sale to buy another property. Just make sure you report this to the IRS. You can also defer capital gains by using a 1031 exchange.

Things get even better when you consider that you can claim depreciation on the cost of buying the property over time. To work out your annual depreciation, divide your expenses by their ‘useful life.’ The IRS defines ‘useful life’ as 27.5 years for residential properties and 39 years for commercial. Remember to subtract the cost or value of the land when determining your purchasing cost. Buildings can depreciate, but the land does not.

You Can Build EquityYou Can Build Equity

Equity is how much of the property you own outright. If you bought with the help of a mortgage, your initial down payment would be your starting equity. Your equity will rise as you pay down the principal on your mortgage. There are a lot of things you can do with that equity. For instance, you can use it as a deposit on another investment property, fund a home renovation, or use it for other investments or expenses like sending your child to college.

Your Real Estate Will Rise in Value Over Time.Your Real Estate Will Rise in Value Over Time.

Real estate values tend to increase over time. If you’ve been smart in choosing a property in a great neighborhood, then the appreciation rate should increase. This can mean big profits when it comes time to sell. The land’s value will also likely increase. In some markets, it’s not uncommon for the land to be worth more than the property. This is a big part of real estate, an excellent long-term investment. You can also go a step further and increase the home’s value through renovations such as a kitchen or bathroom remodel.

You Can Diversify Your PortfolioYou Can Diversify Your Portfolio

Lowering risk through diversification is an integral part of every investment strategy. This way, you won’t lose everything if a market you’re heavily invested in goes south fast. Real estate has a low (sometimes negative) correlation with other major asset classes, making it a very safe investment in times of economic stress. Ideally, you’ll want to spread your investments between different properties, such as residential homes and vacation properties.

You Can Take Advantage of Inflation HedgingYou Can Take Advantage of Inflation Hedging

Inflation is generally bad for investors, but not property investors. As economies grow, the demand for housing also grows. This drives higher rental rates, which translate into higher capital values. Real estate’s protection against inflationary pressure is critical to maintaining its economic power.

Real Estate Investment Trusts (REITs)Real Estate Investment Trusts (REITs)

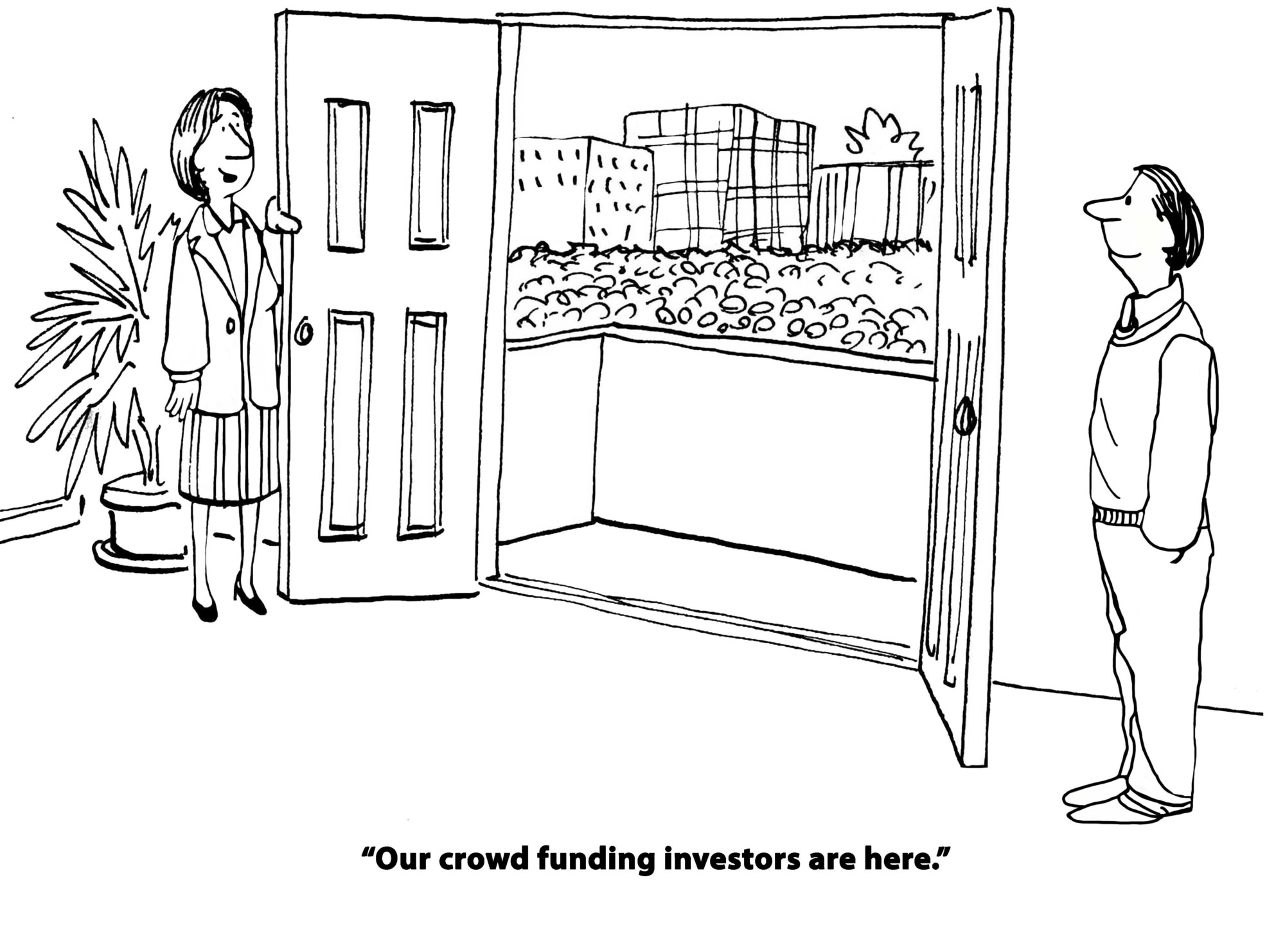

Anyone wanting to get into real estate investing but not wanting the hassle of owning and managing different properties should consider a REIT. This is a company that operates or finances income-generating real estate. Since many are publicly traded on major security exchanges, investors can easily buy and sell them like stocks. REITs tend to trade under high volume and are considered very liquid assets. They also offer very high dividends as they must pay out 90% of their income to investors, a far higher rate than many stocks.

Rental Income Can Pay for Many ThingsRental Income Can Pay for Many Things

Once you earn some income from your investments, you can immediately put that money to good use. You could use it to pay down your mortgage or save for a down payment if you don’t have your own home. You could open a retirement fund if you’re thinking of retiring early. While it’s nice to think of using your rental income to cover monthly expenses or a family holiday, it’s usually better to increase your wealth through further investments. Every big investor starts with a bit of cash flow and uses that to raise it even higher.

Investing is Good for the Local EconomyInvesting is Good for the Local Economy

Any time you purchase a property and fix it up, you put money into the local community and make it a better place for everyone. This creates a home for people, attracts businesses, and encourages more government spending on infrastructure. Over time, this can rejuvenate worn-out neighborhoods and give them a new lease on life.

Real Estate Investing Can Eventually Lead to Owning Your Dream HomeReal Estate Investing Can Eventually Lead to Owning Your Dream Home

We all have that idea of the Dream Home, the home you’ve always wanted and the one you expect to spend your golden years in. This kind of home will be well outside their budget for most people when they first enter the market. But by getting into real estate investing as early as possible, you can build up a sizeable portfolio, strong cash flows, and high equity that eventually, you can make that dream home a reality. It may take some time, but there’s no better way to do it than real estate investing.

Final ThoughtsFinal Thoughts

Becoming an investor might seem like an enormous mountain to climb, but it’s more straightforward than you might think. Make a plan to save enough for that initial purchase, determine your budget, and research the market. Consider hiring the services of a real estate buyer’s agent who can walk you through the buying process and provide vital advice on choosing an investment that will bring long-term returns.