Table of Contents Show

Selling real estate in New York City can be a high-stakes game. With property values and buyer preferences in constant flux, it takes careful research to determine the right price for your apartment. Whether it’s a condo, co-op, or townhouse, you’ll eventually have to settle on a price before putting it on the market. Here are the factors you need to consider when asking, How much is my apartment worth in NYC?

Research your neighborhood selling pointsResearch your neighborhood selling points

If you plan to list your apartment soon, now is the time to look at other listings in your building and the surrounding neighborhood. The quality of life in the neighborhood is just as important as the property itself. An excellent resource for researching your area is AddressReport. It provides data on demographics, crime, air quality, and several street trees. See what other sellers ask for and how your apartment stacks up against theirs.

Compare your building type with similar buildings.Compare your building type with similar buildings.

New York City has many building types, pre-war, post-war, new developments, full-service buildings, etc. When researching other listings in your building and neighborhood, they must be compatible with your apartment.

Don’t try and compare an apartment in a full-service building with one in a low-service one. Or an apartment in a pre-war building with a post-war one. The same goes for comparing a condo and a co-op apartment, as pricing can vary widely.

Check the price per square foot in your building.Check the price per square foot in your building.

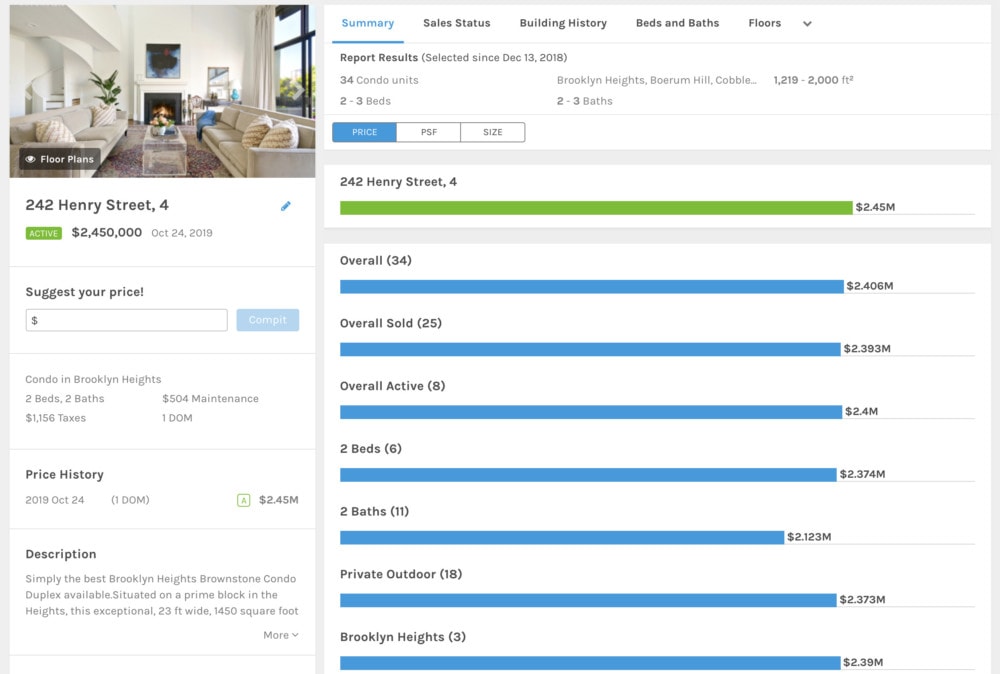

Once you have a list of comparable properties based on your neighborhood and the building type, check your apartment’s price per square foot (PPSF). This is challenging as there are several different interpretations of how PPSF is calculated.

Start by looking at the average and then look at recent sales that were way above the average and way below. It would be best if you started to get a good idea of how your apartment compares. Don’t mistake comparing the PPSF of your older condo to a luxury new development condo whose starting prices are way above yours.

Compare the layout of your apartment.Compare the layout of your apartment.

This is hardly groundbreaking, but you must compare your apartment with properties with a similar bed/bath count and overall layout. Optionality is always valuable. Even if your residence is in the same building with similar square footage, but the other one has an extra bathroom or a balcony, it wouldn’t be appropriate to compare the two. Doing a valuation based on layout adjustments is subjective, but it goes by common sense.

Compare the difference in the condition.Compare the difference in the condition.

It wouldn’t be right to compare a newly renovated apartment with one getting on in years if property A has a newly renovated kitchen or bathroom (generally the most expensive renovations). In contrast, property B does not; and would need a price adjustment.

The price difference between a property with a newly renovated kitchen and one without can be $20-30K. For one, a freshly renovated kitchen and bathroom can be as much as $60k. Another critical factor in the condition is flooring. In NYC, a typical hardwood floor can cost $2-6 per square foot for materials and $2-4 per square foot for installation.

SummarySummary

The right asking price is crucial if you expect a fast and easy sale. You’ve probably priced too high if you’re not getting multiple offers within the first three weeks.

Hiring a good listing broker will give you a better chance of finding the right price. They have market knowledge, insider information, and experience from previous sales of what makes a competitive price. However, you should have a good idea of what goes into an asking price. It will make you savvier when negotiating and deciding on multiple offers.