Table of Contents Show

- Evaluate your cash flow

- Agreeing to too much to get the deal done

- Waiting too long to prep your home for selling

- I did not have a backup plan.

- We do not have a large enough cushion.

- Request an extended closing

- Have your co-op board packet ready

- Using two different real estate agents

- Choose an experienced real estate agent.

- Have a backup plan

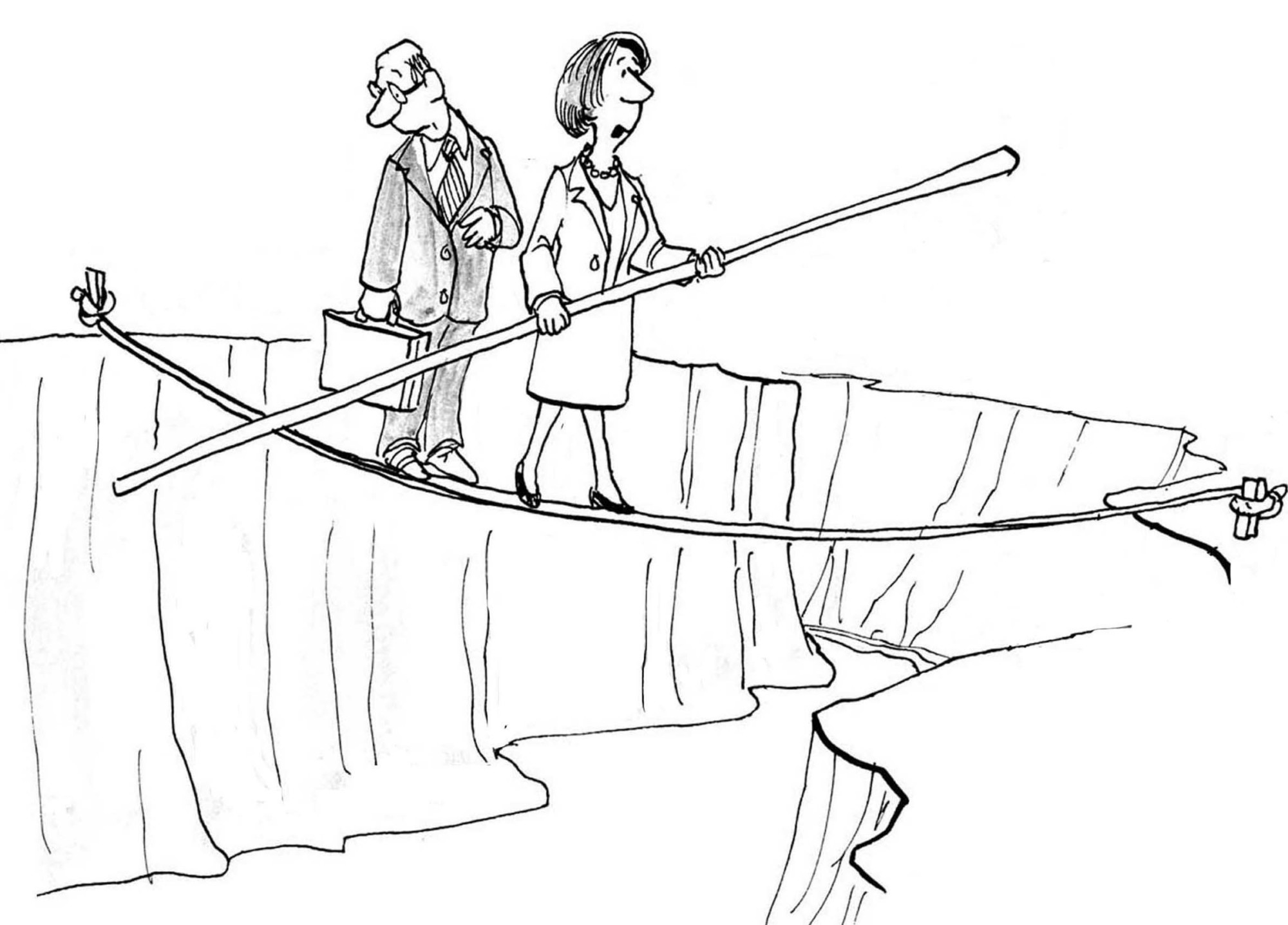

Buying a home can be pretty exciting as you think about moving day, decorating ideas, and your future. Likewise, selling a home can also be exciting as you look forward to that fat check at the end. But are you buying and selling at the same time? You’ll want to handle it carefully if it’s to go off without a hitch. Selling your current home to raise funds for the next one is a standard transaction, but the stakes are high. If the buyer backs out, you’ll be left with no cash to fund the home purchase. If you sell but the home purchase falls through, you’ll be left homeless.

When you decide to sell your apartment, you need to consider where you live next. For sellers, it can feel overwhelming to take on selling your current residence and buying a new one simultaneously. However, while it is a complicated route, it is possible to do both if you organize, use a few tricks, and have extra cash.

Besides the logistics of the move, you should consider a few things through the buying and selling process and the negotiating process to help your move go as smoothly as possible.

While there’s no way to protect yourself against everything that can go wrong, you can avoid the more predictable aspects. Here are tips for when buying and selling at the same time.

Evaluate your cash flowEvaluate your cash flow

The first step to making buying and selling at the same time easier is to evaluate how much liquid money you have at your disposal. A typical downpayment is less than 20 percent of the agreed-upon sale price, so you’ll need that to secure your new condo or co-op apartment.

As soon as you find your new ideal home, you can buy it because you’re not waiting for the other sale to close. If you have enough money for the downpayment on the new apartment before selling your current residence, the process is much easier for you. If you don’t have enough cash for this, you’ll likely need to move into temporary housing or a rental unit before buying your new home.

You could also look into a bridge loan, enabling the bank to cover your downpayment on the new apartment until your current apartment sale closes. However, bridge loans are often risky for the lender and buyer, so they are not as commonplace in the competitive New York City market.

Depending on your family and friends’ situation, you could ask for a personal loan to secure the 20 percent downpayment until the sale of your current home closes.

Agreeing to too much to get the deal doneAgreeing to too much to get the deal done

You’ll be under a lot of pressure during negotiations by handling two different transactions at once. Those you’re dealing with may be aware of your situation and could be using that to make extra demands. Don’t cave in just because you want to get the deal done. Make sure you’re okay with what you agree to and that you’re not being taken advantage of. If you need time to think something over, then tell them. This will delay the closing, but that’s better than an expensive financial mistake.

Waiting too long to prep your home for sellingWaiting too long to prep your home for selling

Before a home can be listed, consider – The walls might need a new coat of paint, the carpets a deep clean, and the rooms have to be decluttered. It takes time, and it shouldn’t be left to the last minute when you’re simultaneously buying and selling. Start prepping your home for selling before you start submitting offers and visiting open houses. Otherwise, you could get an accepted offer only to find yourself scrambling to get your home ready for selling. With the current buyer’s market in New York City, you may not have difficulty finding a place to buy, but finding a seller will be a different story.

I did not have a backup plan.I did not have a backup plan.

A real estate transaction has many moving parts, and when you double the size of the deal, the chances of something going wrong go up. Scheduling a closing day that will suit you (for both transactions) will be especially tricky. Have a backup plan if you can’t buy and sell simultaneously. An emergency fund will provide the cash needed for a short hotel stay, but you may also have to consider a short-term rental. Your guiding principle should be “Hope for the best but expect the worst.”

We do not have a large enough cushion.We do not have a large enough cushion.

The real estate market can be very volatile. Even a haven like New York isn’t without sudden price drops and times in the year when the market goes cold. You need to sell your current home for a minimum to pay for your next one. But ask yourself, can you still do that if the market softens and you have to revise your asking price by $20,000? If not, then you can wish goodbye to your down payment. Give yourself a little cushion on what you need to sell to buy a new home. If you need all the money you’ll make from the sale to complete the purchase; then it’s better to assume you’ll get less than expected.

Request an extended closingRequest an extended closing

If you plan to buy before selling your current apartment, requesting an extended closing date can help you use your apartment’s equity to buy the new one. However, to execute this process in good faith with the other party in the deal, you’ll want to communicate this desire immediately. If you ask for an extended closing in the middle of the process, you’ll risk complications with the seller.

You’ll also only want to go this route if you’re sure your new apartment will sell within the negotiated contractual timeframe. While some sellers may be open to extended closings if they are also trying to find a new home, this situation works best in a buyer’s market with little competition.

Have your co-op board packet readyHave your co-op board packet ready

The co-op board reviews each applicant’s complete finances for anyone who purchases an apartment in a co-op building. So, if you own another apartment while trying to buy a new one, the co-op board will be aware of it. Some co-op boards don’t feel comfortable approving applicants with two apartments if your finances don’t reflect a long-term stable pathway to owning both places.

If the co-op board does not care as much about this, it’s still good to know that waiting to pass the co-op board interview for your new apartment could delay closing. So it’s a good idea to compile your board package as soon as possible to help expedite the process within your control.

Using two different real estate agentsUsing two different real estate agents

With two transactions at once, things are already messy enough; don’t make it more chaotic by having two real estate agents. Instead, have one agent who can coordinate both for you. You’ve got a far better chance of closing on both simultaneously. The only exception to this will be if you’re moving between states. If an agent you like works exclusively with buyers or sellers, not both, then ask for a recommendation within their brokerage. You can keep things smooth if both transactions are under the same roof.

Choose an experienced real estate agent.Choose an experienced real estate agent.

In almost all cases, it is a good idea to have a seasoned real estate agent on your side, but this is especially true when you are buying and selling simultaneously. A real estate agent can help you manage the logistics of closing on both apartments, negotiate with the seller and buyer on timing, and help you get the best deal for both homes without feeling rushed or pressured.

Unless you’re moving out of state, keeping the same real estate agent for both transactions can help you minimize agent costs and headaches. Your agent can tell your buyer and seller that you’re moving and ask for leeway with closing dates to make both sales work. Having the same agent can also help keep your agent in the loop about the logistics of moving by on both sales.

Have a backup planHave a backup plan

While it is possible to sell your current apartment and buy a new one simultaneously, have a backup plan to save yourself some stress. Remember that you’re not the only person moving in these sales, and three different families or couples will need to move apartments simultaneously to make this work. Perhaps you might need a storage unit or stay in a hotel for a night or two.

If your buyer for your new home falls through, consider renting out your old place on a six-month lease until you’re settled in your new home and can re-focus your selling efforts. If a problem arises with your new home, you and your family can rent temporarily until the new place closes.