Table of Contents Show

Touring a neighborhood and building is essential to your due diligence as a buyer. However, you can go even further to provide yourself with a competitive edge in the New York City real estate market. Although you also enjoy the benefit of living in your apartment, this is likely to be your biggest investment.

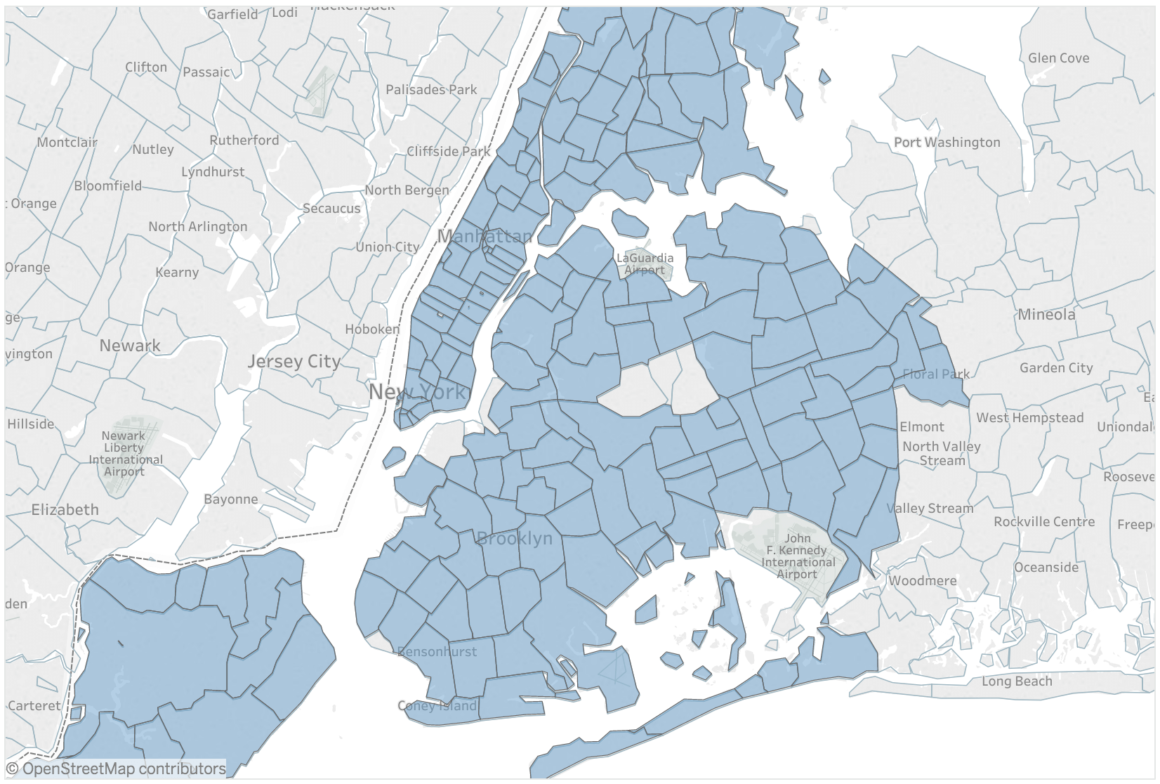

LendEDU put out a study, using data from Experian, dissecting New York City neighborhoods by six financial metrics. The areas were ranked using these scores.

We give a breakdown and interpretation, attempting to see what the financial implications are going forward.

Credit scoresCredit scores

The study uses VantageScore 3.0, which has credit scores ranging from 300 to 850. A score above 750 is considered “excellent,” similar to the FICO score. There were no neighborhoods that had an average score in that range, but many are in the 700-749 area, which is considered “good.”

Interesting, Queens and Manhattan dominate the top 25. Familiar areas, such as Yorkville (which now has a train servicing the area), Upper East Side, Upper West Side, Battery Park, and Chelsea, are on the list. If you are interested in Queens, the close-knit Breezy Point community topped the list, followed by Douglaston and Clearview, both of which have a more suburban feel.

On the flip side, the bottom 25 has many neighborhoods in the Bronx, with Hunt’s Pont at the bottom with an average score of 611. A score in the 550-649 range is considered “poor,” which is the second lowest category. In Manhattan, Washington Heights, Harlem, and East Harlem were in the bottom with credit scores in the poor range.

What does a high credit score mean? There are many historical factors, such as your payment history and credit utilization. You can take some comfort in knowing that people in these neighborhoods have substantial credit, which makes it less likely there will be large-scale defaults.

On the flip side, an area filled with poor credit scores could mean a greater number of mortgage defaults, lowering the value of your property, even if you make your mortgage on a timely basis.

The study also ranked credit card balances, but the list is counterintuitive. While most would think a large credit card balance indicates financial stress, based on the top neighborhoods (Battery Park, Upper West Side, Tribeca, Wall Street, Tottenville), this is not the case. It appears that high levels of credit card debt are associated with an increased ability to pay.

IncomeIncome

The study ranks neighborhoods by an income score. This is a broad measure, counting wages, rent, investment income, and even alimony. The top portion of the list is dominated by Manhattan areas, such as the Upper West Side (10069 zip code), followed by Tribeca, Battery Park, Lenox Hill, and Yorkville. Bronx neighborhoods are on the bottom of the list, including 14 out of the lowest 15.

If you are moving into a co-op, the board has certain income standards, giving you greater comfort. However, if you are moving into a condo, checking the income rankings can give you greater comfort that owners have a greater ability to make their mortgage payments.

Mortgage, student loan, auto loansMortgage, student loan, auto loans

Higher mortgage debt is associated with the more expensive zip codes. Manhattan dominates the list due to higher home values. This includes Battery Park, Tribeca, the Upper West Side, Upper East Side, NoHo, Yorkville, and Lenox Hill. There are many Bronx neighborhoods on the bottom of the list.

Manhattan also dominates the top of the list for student loan debt. Lenox Hill, Upper West Side, Yorkville, Upper West Side, and Stuyvesant are a few neighborhoods that are in the top 10. This could mean a younger, higher educated population, with greater earnings potential. This would be a positive. However, should a recession occur, the greater student debt burden could place the owner under financial stress that could cause mortgage defaults and deteriorating home values?

Bronx neighborhoods represent more than half the top 25 for the highest auto loan balances, with Brooklyn and Queens areas also on the list. Many Manhattan residents do not have a car, making this harder to interpret.

Concluding thoughtsConcluding thoughts

It is best to read the six different categories in conjunction with each other. For instance, many of the neighborhoods with high income also have a top credit card, student loan, and mortgage debt. In other words, residents in these areas appear better able to handle the increased debt load. However, you should be aware that higher debt also could create more risk in the event of a recession, when incomes could drop.