Table of Contents Show

You probably spent a lot of time looking and saving for that New York City apartment. But before you can start choosing paint schemes and moving in, you’ll need to get your homeowners’ insurance sorted for your co-op or condo. Unfortunately, many first-time buyers make a big mistake thinking about the building’s insurance policy; the master building policy will cover their apartment.

A home purchase is perhaps the most significant investment you’ll ever make, so naturally, you’ll want that investment protected with excellent coverage. However, it doesn’t. The master policy will cover the walls and common areas, but anything inside the unit is your responsibility. To save time, money, and regret, you must know what questions to ask when shopping for apartment insurance. We also delve deeper into this arcane topic and homeowner insurance vs. home warranty.

What Does Homeowner’s Insurance Cover?What Does Homeowner’s Insurance Cover?

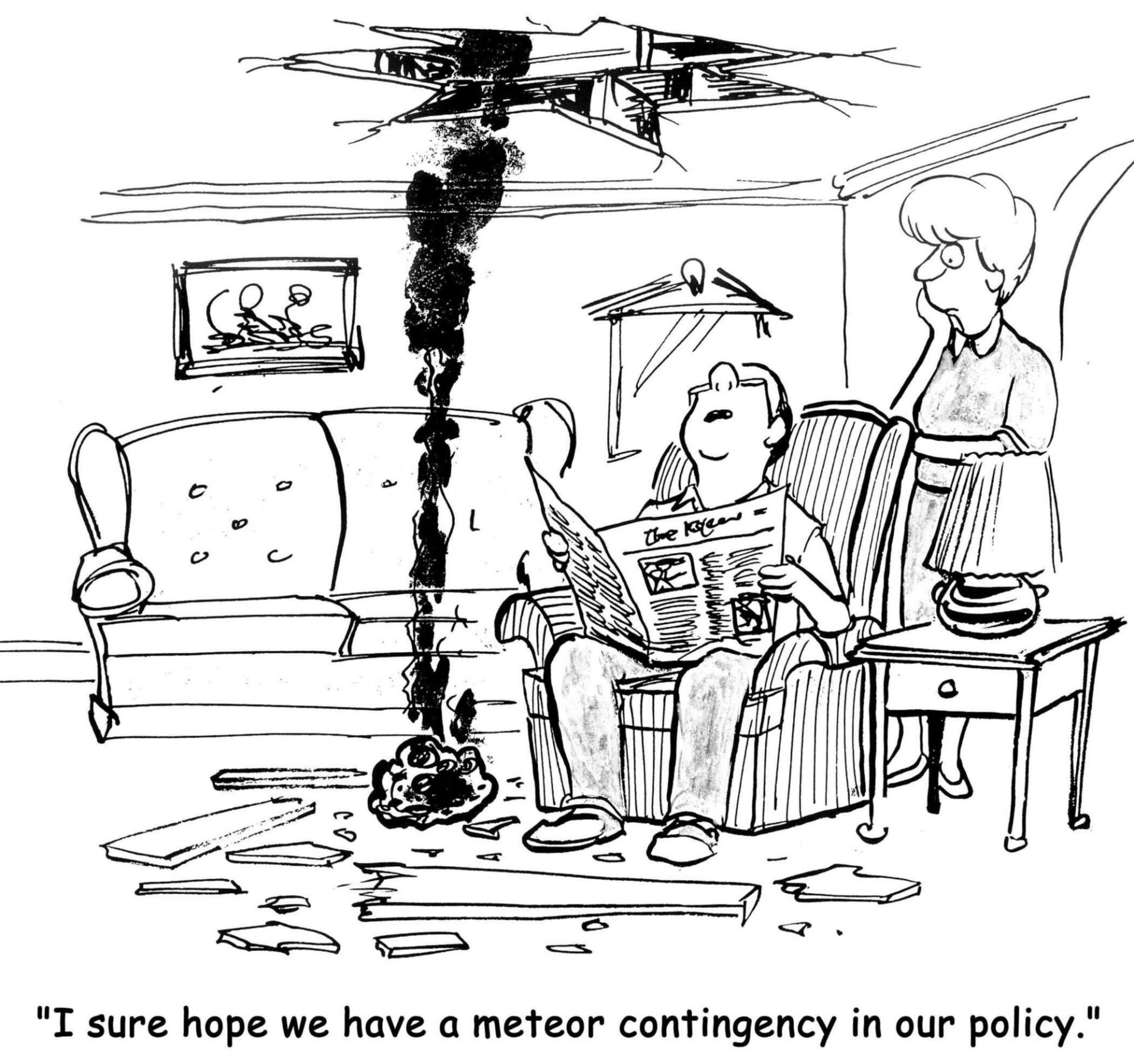

An HO-6 insurance policy covers the home, along with possessions inside. They protect against damage to your property and any liability that may arise from injuries or property damage caused by you or your family members. Events such as fire, theft, and specific natural disasters are typically covered. This country’s policies usually include wind damage (this may not be the case in other states, such as Florida).

Most policies specifically exclude damage from floods and earthquakes. Although earthquakes are not a concern for apartment dwellers in New York City, problems caused by a lack of maintenance, such as leaky pipes, will be your responsibility to fix.

Coop and condo insurance includes three basic types of coverage: contents, walls and floors, and personal liability.

ContentsContents

Most of your personal property is protected, for example, electronics, clothing, and furniture, from the dangers of fire, theft, and water damage. How well they are covered depends on how much you pay to insure them; entirely up to you. The only things limiting how much you can ensure are jewelry, silverware, and fur. These will require extra coverage if you want them insured in full. In addition, you might want additional coverage on business equipment if you work from home, with the basic package that may not be covered.

Walls and FloorsWalls and Floors

It covers the walls and floors of your unit, plus any renovations you’ve done, such as the bathroom or kitchen. It costs about $250 per square foot to rebuild a typical NYC apartment. However, for a more high-end apartment or one in a pre-war building, the cost can be as much as $700 per square foot. Since the risk of a total loss is negligible, most people don’t insure the total amount. Instead, they strike a balance between what they can reasonably afford and a level of coverage that won’t cause financial ruin in a major disaster.

Personal LiabilityPersonal Liability

Personal liability covers bodily injury incurred by guests/visitors in your home. It will also include any damage to your neighbor’s apartment, such as water damage from an overflowing bathtub. This is the most common claim, so you’ll want to ensure you have this.

How Much Will Co-op or Condo Insurance Cost?How Much Will Co-op or Condo Insurance Cost?

How much insurance coverage to purchase depends on the value of your home and possessions. Therefore, it is incumbent upon you to calculate how much you need to protect. First, look at the value of your home. Your insurance agent can help you with this by going through the various features, such as square footage, the number of bedrooms, and other items that would affect the value. You should seek the replacement cost. Replacement costs will pay out the amount to replace the item, even if it has depreciated. You will have to prove you repaired the issue instead of the actual cash value, which pays the original cost less depreciation.

The most basic policy will cost between $300 and $400 per year. We will get you about $25,000 for your content, $20,000 for the floors and walls, and $100,000 for personal liability. It is not a lot, and you’ll have to pay out of your pocket for a substantial claim. More extensive coverage will cost between $450 and $650 a year, covering $50,000 for contents, walls, and floors and $500,000 for personal liability. Finally, the most extensive coverage will cost between $1,100 and $2,400 and provide $100,000 for content coverage, $300,000 for walls and floors, and $1 million for personal liability.

Inventory ListInventory List

You must make an inventory list of the items in your home. Then, it is easier to determine how much coverage you need and expedites a claim should you have to create one. It would be best to list your possessions, particularly significant ticket items, including the make and model, receipts, and appraisals. It is also good to take pictures and videotape a walk-through, which should be kept in a secure place such as a safe deposit box.

The Insurance Information Institute states that increasingly $300,000 to $1,000,000 is recommended for liability coverage. However, consider adding to this amount if you have a high net worth.

What Doesn’t Your Insurance Cover?What Doesn’t Your Insurance Cover?

Typically speaking, condo or co-op insurance will not cover any of the following:

- Damage or loss of use of the apartment due to rising flow of waters

- Dog bites from dangerous breeds (i.e., Pitbulls)

- Earthquakes

- Vermin or insect damage

- Wear and tear

- Short-term renters of less than 3-6 months

Is Temporary Housing Covered?Is Temporary Housing Covered?

They may cover your apartment and contents safely, but what about temporary housing costs if anything should happen? No matter the plan, every policy will have some “loss of use” coverage. However, some homeowner’s insurance policies will have time limits, while others will only provide a percentage of your content insurance. Be sure to ask about this and check the fine print.

Does your building or lender have special requirements?Does your building or lender have special requirements?

Before buying any homeowner’s insurance, you’ll want to check with your building and mortgage lender for any special requirements. For instance, water damage is the most common claim in NYC housing. Both condo and co-op boards want to see that you have enough liability coverage to deal with them. Vital as they don’t want to have the building’s master insurance invoked or get involved in the claim process. Also, they’ll require you to have enough coverage to rebuild quickly in a significant loss.

How big should your deductible be?How big should your deductible be?

Your deductibles, the amount you pay on a claim before being reimbursed, can go from $250 to $2,500. rIn extreme cases, it can be up to $25,000. You’ll save about 10% on your premium on the first few increases. After that, you’ll start to get diminishing returns. It’s best to get the highest deductible you can afford. It will discourage you from making minor claims. Making two or more claims in three years can make it difficult to renew your insurance and land you on an industry blacklist. If that happens, you’ll need to pay for more expensive coverage on the secondary market and wait several years without making a claim.

Am I covered if I sublet or only live there part-time?Am I covered if I sublet or only live there part-time?

If you plan to rent your apartment for at least six months, you can modify your insurance to cover you. Just make sure you inform your Homeowner’s insurance broker of this. Anything less than that, and you won’t be covered. If you stay in the apartment only part-time, your insurance will still protect you. However, the condo or co-op apartment must remain furnished. Check the wording in your policy to see how this applies.

Why do I need homeowners insurance?Why do I need homeowners insurance?

Your lender will likely require homeowners’ insurance if you have a mortgage. Such insurance protects the mortgage lender, which has a lien on your property; your home is damaged in the event.

It is strongly advised that you take out a policy for those that do not have a mortgage — a significant asset, perhaps your biggest one, particularly given real estate values in New York City. You will likely want to protect your interest from an unfortunate event. It also covers you should someone get injured and decide to sue you. The board may require you to buy insurance if you have purchased a condo or co-op.

Remember that a homeowner’s insurance policy differs from a home warranty. The latter covers specific items in the home. For example, if one of these breaks down, it could include the dishwasher, air conditioner, refrigerator, and washer/dryer. However, as a homeowner’s policy does, it does not cover a loss from a natural disaster or theft.

What are the insurance premiums?What are the insurance premiums?

Several factors will affect your Homeowner’s insurance premium. Such insurance covers the home’s features, location, and protective devices, such as an alarm system and smoke detectors. Your premiums will also be lower if your building has a doorman, security guard, or a modern fire alarm system.

There are several tips to try to save money on the premium. First, shop around. With the Internet, this is easier than ever. Beyond that, purchasing homeowners and car insurance through the same company will likely get you a discount. In addition, there may be other discounts you are eligible for, such as professional affiliations. Finally, depending on your risk tolerance and the amount you can afford to spend should something happen, your premium will be lower if you are willing to have a higher deductible.

How to find the right Homeowners Insurance?How to find the right Homeowners Insurance?

How do you choose when the free market is flooded, with homeowners insurance companies vying for your business? Overall, seek out providers that offer both integrity and affordability.

What should you look for in Homeowners Insurance?What should you look for in Homeowners Insurance?

New Yorkers face the problem of annual homeowners’ insurance premiums over $100, the national average of $1,034, which means that New Yorkers have to pay more than the rest of the nation’s homeowners for the same coverage. Thankfully, by exploring your options and taking all the necessary precautions, you can still have excellent protection for your home without sacrificing too much of your hard-earned money.

Choose an Insurance Company That’s Upfront with Costs and CoverageChoose an Insurance Company That’s Upfront with Costs and Coverage

Insurance providers vary in their levels of price and coverage transparency. As a homeowner, you need to find a company that’s 100 percent open about what you’ll pay and very specific about what you’re getting for your money. Be sure to explore the fine print. If you see too many odd “exceptions” to your coverage, ask questions, but it’s probably wise to keep shopping.

Find One That Recommends Only, What You NeedFind One That Recommends Only, What You Need

An insurer that pushes you to pay for add-ons like earthquake coverage when the risks for NYC tremors are relatively low probably isn’t the right choice. Instead, you want a provider to offer valuable additions like flood insurance. Since rising waters pose problems for homes on Long Island, investing in this add-on to your plan could keep you from some future trouble.

Look for an Insurance Company That Offers DiscountsLook for an Insurance Company That Offers Discounts

You should explore the option of covering everything with one provider if you have multiple insurance needs. Insurance companies that offer life, auto, boat, and home insurance in bundle discount packages can take some of the stings of your finances. Plus, lower prices mean you can get good coverage for lower rates.

You will also want to find a provider who offers better premiums; when you lower your home’s risk factors. A good insurance company will also discount new homes, customers, and retirees. When a company offers the right incentives, you know they value your patronage.

A Good Provider Will Charge You Based on Your Home’s True ValueA Good Provider Will Charge You Based on Your Home’s True Value

You don’t want to pay for coverage for a million-dollar home when your dwelling is worth $700,000. However, since your home’s replacement cost plays a significant role in the size of your premium, getting an accurate appraisal is vital.

Don’t let an insurance provider’s assessment be the final say. Instead, get a home builder or appraiser to offer a second opinion. With third-party help, you can often get more accurate assessments that grant you a more reasonable premium. However, if your company won’t open to evaluations from other professionals, it’s time to keep shopping.

You don’t have to skimp on coverage to afford homeownership in New York. Instead, look for homeowners’ insurance and do business with an honest and fair provider.

Homeowners Insurance vs. Home Warranty?Homeowners Insurance vs. Home Warranty?

We have previously discussed the importance of home insurance. Lenders require it, although we recommend having insurance even if you do not have a mortgage.

However, this is different than a home warranty. While you can consider both types of insurance, each covers other circumstances.

Home InsuranceHome Insurance

A home insurance policy covers expenses for your repairs when an event, such as a natural disaster, fire, or theft. When shopping for an insurance policy, you need to understand what Homeowners and the deductible are. You can choose a higher deductible to lower your premium, but this provides less protection since you have to pay more out of pocket if you need the insurance.

For a condo, you own the unit, so you need to ensure it and all of your contents. In a co-op, you are a shareholder, holding a percentage of the entire building. In this case, you should have insurance for your personal property, and the co-op board will purchase a policy that covers the building. In addition, your monthly maintenance fee contributes to funding the plan.

Home warrantyHome warranty

You are not required to have a home warranty. Home warranties cover specific appliances when they break down, either paying for the repair or giving you money towards a replacement, depending on the policy’s details. Unlike a home insurance policy, which would cover the items when there is a specific event, a home warranty covers the Homeowner for everyday wear and tear.

The items include the furnace, air conditioning, washers/dryer, and dishwasher. Again, it behooves you to examine the specific policy to see your coverage and deductibles. It is not unusual for the plan to have a modest deductible. The basic warranty may not cover the most expensive items, although you can purchase additional coverage to include topics not covered in your policy.

A negotiable itemA negotiable item

When purchasing a home, you can ask the seller to pay for a home warranty for a period, typically a year. If the appliances are older, this helps. Sellers might go along to alleviate the buyer’s anxiety and help close the deal. Several years ago, a survey conducted by American Shield, a large provider of home warranties, showed homes with a home warranty sold faster and for more money.

Cost-benefit analysisCost-benefit analysis

If you are getting a home warranty on your own, weigh the premium cost against the potential repair expense. You might find it more economical to place the money in a fund you can use for repairs or replacement. However, creating an individual savings account and regularly contributing money takes discipline. Then, of course, if you are handy, you might not need a home warranty policy at all.

You do not get to choose the person to conduct the repair. Instead, you call the warranty company when something breaks down, which sends someone from one of its contracted repair companies. You should keep this in mind if you already have someone in mind that you like very much.

Final thoughtsFinal thoughts

Homeowners insurance is a topic akin to going to the dentist. It may be necessary, but many do not find the experience pleasant. However, it is an essential step if you plan on being a homeowner. Getting the right amount of insurance can save you headaches later.