Table of Contents Show

A mortgage contingency clause protects the buyer from not losing a down payment. Many sellers frown upon contingencies since they complicate the deal and protect the buyer with the ability to walk away should there be a problem with your loan. However, it is typical to include this clause in a real estate purchase contract.

You should fully understand this contingency and how it protects you, the buyer. It is instrumental if you are a first-time homebuyer and have never been through it. At times, buyers may wish to waive their mortgage contingency clause. For example, during string markets in New York City with tight inventory, you can help level the field with all-cash offers. However, we advise using it judiciously since there are pitfalls that you need to be aware of, given that you are risking your down payment.

We explain the mortgage contingency clause and when it is advisable to use it to protect you.

DISCLAIMER: This article does not represent any form of legal advice. Please consult your real estate attorney.

Why use a Mortgage Contingency?Why use a Mortgage Contingency?

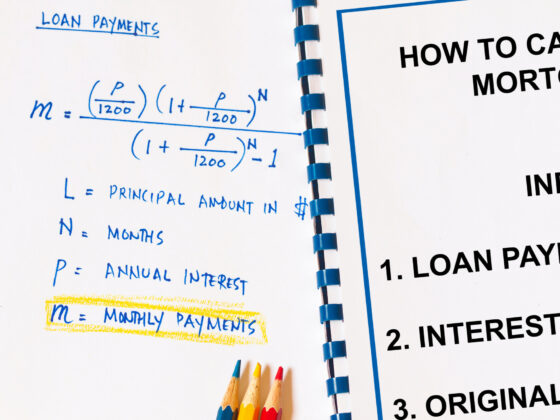

The mortgage contingency clause gives the buyer a specific time to obtain a mortgage. Should the mortgage be denied, the buyer is not obligated to proceed with the purchase and is entitled to a full refund of the contract deposit.

The standard time for the buyer to get a mortgage commitment is thirty days or sixty days. A quick turnaround- therefore, it is incumbent upon you to speak to your lender before signing the contract and keep in contact throughout the process. Once you have received a counter-signed contract, you should immediately forward a copy to your lender. In addition, you should promptly send any paperwork requested by the lender to keep things moving. Asking for a few extra days does not usually present a problem, but it is advisable not to go past this or ask for a second extension.

Good Faith EffortGood Faith Effort

Once you agree to the terms, a mortgage contingency is a standard part of the contract. Otherwise, they can back out of the deal without penalty, and any money paid to date gets refunded. However, there are a couple of caveats that usually apply. First, the buyer must make a “good faith” effort to obtain a loan, fill out the loan application accurately, and promptly follow through with a bank’s requested information.

Once the bank approves your loan application, the buyer has to go through with the purchase unless other contingencies exist.

Types of Contingency ClausesTypes of Contingency Clauses

We have seen that the contingency clause is flexible. Aside from that, there is the current contingency provision, passive loan contingency, and a hybrid. The active contingency gives the buyer more control. It requires the buyer, in writing, to waive certain conditions for the deal to go through.

A passive contingency is more stringent and less favorable to the buyer. For instance, it could require the buyer to notify the seller when he has not obtained a mortgage. Failure to do so puts the buyer on the hook to purchase the property, even if there is no mortgage. A hybrid contingency is a middle ground, as the name suggests. Buyers agree to forfeit a portion of the deposit. Again, the wording of the mortgage contingency is crucial.

If there is a bidding war in a seller’s market, you can propose a mortgage contingency for the sales price. If the appraisal falls below the sales contract price, the buyer would promise to cover the shortfall. Alternatively, the wording could allow the buyer to walk away, which may serve as an impetus to renegotiate the deal.

When to waive your rightWhen to waive your right

First, check with your real estate attorney and buyer’s agent, but you may decide to forgo the mortgage contingency to make your offer more competitive, particularly in a seller’s market. If possible, resist this urge, even if you feel confident, if you have been pre-approved. However, a loan pre-approval is non-binding, and other factors may come into play. Moreover, credit conditions can change, and this clause protects you in such an event. Finally, you will void the sales contract without penalty, providing a reasonable faith effort made during the specified time.

While a contingency is in place to protect the buyer, there are times when you should consider waiving this right. We recently discussed the “best and final” offer situations where you can strengthen your offer by placing fewer contingencies. It would help if you did this only when you want the property; it is very desirable, and you find yourself in a competitive bidding situation.

When Competing with all-cash bidsWhen Competing with all-cash bids

If competing with all-cash bids, consider waiving your contingency to make your offer more competitive. But, of course, if the seller receives a cash offer with a smooth close and no conditions, which is higher than your bid, you do not stand much of a chance.

The seller, naturally, wants the deal to close. He is indifferent to the interest rate level you will have to pay or if the other terms are onerous. The buyer may want to ensure a deal only if he can receive specific favorable mortgage terms. For instance, a 30-year mortgage below 6% might be a contingency. There is a compromise, but it is essential to have one included unless you are an all-cash buyer or put down 50%. Otherwise, you risk losing the 10%-20% deposit you have put down.

What’s at risk?What’s at risk?

It would be best to have confidence that you will obtain a mortgage within the prescribed time frame. If you fail to do so, you risk forking over your deposit to the seller, which easily could be a five or even a six-figure amount.

Obtaining a mortgage pre-approval can mitigate your risk substantially. However, a change in the economy (causing lending standards to tighten) or your employment situation could cause the bank to balk at extending the loan. In this case, a backup plan with alternative financing sources, borrowing from friends/relatives, or tapping your retirement plan is handy.

The lender could also come in with a lower-than-expected appraisal. In this case, the bank will only extend you a certain amount of credit. It is then up to you to come up with the additional funds.

It’s not all-or-nothing.It’s not all-or-nothing.

You do not have to waive the mortgage contingency entirely. You can put in that you must obtain a mortgage unless the bank refuses to make the loan due to circumstances beyond the buyer’s direct control, such as their financial position. However, this does not put you in a strong position as entirely waiving the mortgage contingency clause.

You may be confident in obtaining a mortgage based on your credit and financials, but the bank must also extend the loan based on the building. It could deny the loan based on any number of circumstances. These include the building’s weak financials, liens, litigation, or even if the sponsor holds too many units. If you choose to waive the contingency, we advise keeping it in place based on the building.

While this may not put you in as strong a position, this protects you from events outside your control.

Concluding thoughtsConcluding thoughts

The tide turned in New York City’s housing market several years ago. You may feel you have found the perfect home and risk losing it. However, the mortgage contingency clause is there for your protection. Before choosing to forgo a contingency that could get you in severe financial straits down the road, consult your lender, buyer’s agent, or an attorney.