Table of Contents Show

These ten questions are just the right ones, so have them ready for that first meeting ahead with your chosen bank loan officer. Whether you are applying for a mortgage or refinancing an existing one, it helps prepare you well. Ask the right questions, and the whole process will go much smoother and quicker.

How much business do you do in NYC?How much business do you do in NYC?

Don’t overlook this if this is your first time buying or financing real estate in New York City. The property market here can be a little more complicated than in the rest of the country, so choosing a bank that understands it can be crucial to a deal. Choose a bank with a lot of experience lending against co-ops and condos in New York City. You’ll then be less likely to meet any delays in closing the deal.

Can you explain what types of loans you offer?Can you explain what types of loans you offer?

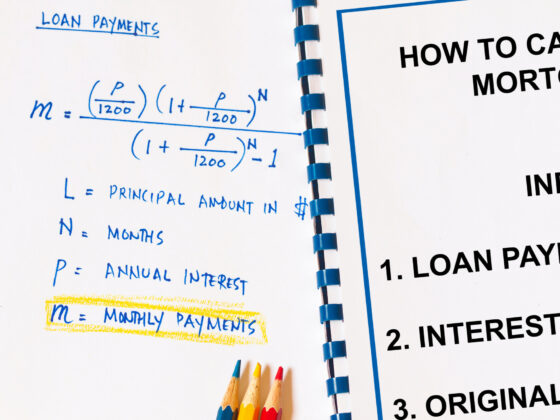

There are many types of loans that banks offer. People ask about the most common ones are the portfolio, Fanny Mae, and conventional loans. Chances are you will hear some that may not be familiar. Have them explain each one carefully so that you understand their terms.

How can I get prequalified for a mortgage?How can I get prequalified for a mortgage?

Being prequalified can boost your chances of getting your offer accepted. It usually takes about 10 minutes, and once done, you can print out a pre-qualification letter as proof.

Is the building I want to buy pre-approved?Is the building I want to buy pre-approved?

Once pre-qualified, you will next want to find out if the building is as well. If it’s not, the mortgage loan process will take longer as your bank will need to conduct due diligence. However, if it’s a reasonably sized building and isn’t brand new construction, then you will be approved by the pre-approved lender.

What’s the difference between a pre-qualification letter and a mortgage commitment?What’s the difference between a pre-qualification letter and a mortgage commitment?

If it’s your first loan, ensure you fully understand this difference. Pre-qualification only means you are qualified for a loan depending on the verification of specific items. All it verifies is your credit report. Before They can issue a commitment, the bank will need to gather supporting documents for the information you gave in the pre-qualification, conduct due diligence, etc.

How long are your rate locks?How long are your rate locks?

The most common rate locks offered are for between 30 and 60 days. However, large banks sometimes provide as many as 90 days. You’ll want to avoid extending your rate lock, so try to get one as flexible as possible.

What is your mortgage underwriting process?What is your mortgage underwriting process?

You’ll want to know how much bureaucracy exists in the bank. Is the mortgage underwriter someone that can be reached, or is an offshore team only reachable by email with a one-day lag time? The more lag time, the more delays in getting approval. This is an excellent question because it allows you to test how knowledgeable the loan officer is.

Are there any relationship pricing incentives?Are there any relationship pricing incentives?

It is common for large banks to have relationship pricing incentives if you have a depository relationship with them. Depending on the amount of cash you have deposited with them, you can get a reduced mortgage interest rate.

Do you have any home buyer closing incentives?Do you have any home buyer closing incentives?

Some banks offer closing cost incentives to first-time homebuyers or those with a low income in conjunction with the government. These incentives can range from small to large. For instance, $500 is added to your checking account when you begin a depository relationship with the bank in conjunction with the financing. Or a substantial $5,000 closing credit for first-time buyers.

How much must I put down, and how high must my debt-to-income ratio be?How much must I put down, and how high must my debt-to-income ratio be?

Every bank is different when it comes to these questions. A 20% down payment is needed; otherwise, you must take out mortgage insurance. Anything less will require mortgage insurance. Each bank has its way of calculating its debt-to-income ratio. In general, your debt-to-income should be at or above 36%.