Table of Contents Show

Mortgage points are upfront interest a buyer pays at closing. For example, if you choose to pay two points on an $800,000 mortgage, $16,000 is due at closing or rolled up on your mortgage. One point equals 1% of the original loan balance.

It seems counterintuitive that a buyer would consciously choose to pay extra costs. Still, you need to weigh certain factors in determining if this is financially beneficial to you.

Why pay mortgage points?Why pay mortgage points?

You may not be in the mood to fork over additional monies, the reasoning you have paid enough for a New York City apartment, particularly when you factor in closing costs. There are legitimate, financially sound reasons when it makes sense, however.

Mortgage points, referred to as discount points, amount to paying immediate interest to the lender. You receive a lower interest rate in exchange for the lender’s access to the funds.

Therefore, you need to consider the time you plan to spend in your new home and the interest rate you will pay with and without points. The longer your time frame, the more attractive it is to pay points.

Break-even pointBreak-even point

Referred to as your break-even point, it is the crux of whether or not to pay points. Once you have these critical pieces of information, you can calculate how long it will take to recover the points paid. After this period, you will have made money – primarily; it is money in your pocket.

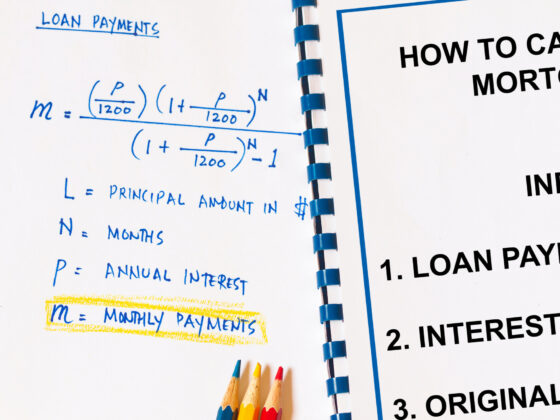

It is a simple calculation. First, compare the interest rate on your mortgage with no points to one with mortgage points. Then, divide the cost paid for the points by the monthly savings achieved due to the lower interest rate — your break-even period of months.

You can pay a range of points, starting with zero. But, it is easy to do the calculation for each scenario.

Applying the conceptApplying the concept

A numerical example will clarify the idea. A lender offers a 30-year fixed mortgage at 4% with no points. However, you can lower your borrowing rate by 0.25% to 3.75% if you want to pay one point.

Assuming you are taking out a $600,000 mortgage, your monthly payment (principal and interest) under the 4% loan is $2,864.49. However, if you decide to pay the point, your monthly payment under the 3.75% rate is $2,778.69.

Your monthly savings under the one point/3.75% rate is $85.80. However, you have made an upfront payment of $6,000 (1% of $600,000). Therefore, your break-even period is 70 months.

Based on this calculation, if you plan to stay longer than this, you should consider paying the point and taking the lower rate.

Income taxesIncome taxes

The points you pay may be tax-deductible as mortgage interest, providing you itemize your deductions and your mortgage is not greater than $1 million. However, Congress is currently debating tax legislation that could lower the deduction to interest on a loan up to $500,000.

Other factorsOther factors

While running the numbers gives you a basis, remember to consider your financial position, particularly your cash balance. For instance, you may want a 20% down payment to avoid taking out a private mortgage insurance (PMI). Also, co-ops may have rules on the liquidity you must have after closing, which could be one to three years of maintenance and mortgage payments.