Table of Contents Show

New York residents should know a mortgage recording tax for new and refinanced loans. The state and city charge the recording tax, but the latter consolidates the amount in one bill. Therefore, the applicable rate depends on the mortgage amount, with the payment due at closing when purchasing a condo, townhouse, or house.

Who Pays Mortgage Recording Tax in NYC?Who Pays Mortgage Recording Tax in NYC?

The mortgage recording tax only applies to properties such as condos, townhouses, or houses. This means it does not include co-ops, which are shares in a corporation. In addition, since it only applies to those taking out a mortgage, cash buyers are also exempt from the tax.

What is the Mortgage Recording Tax rate?What is the Mortgage Recording Tax rate?

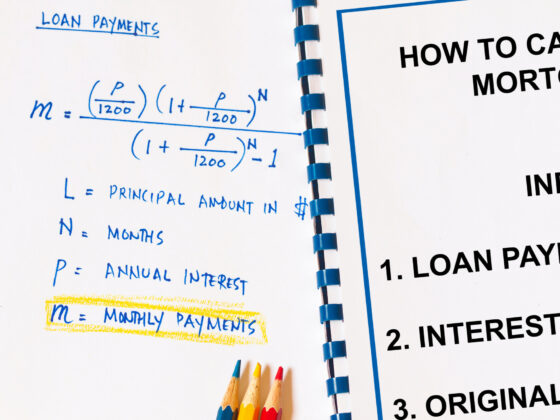

Different rates are triggered at varying borrowing levels. It is inclusive of New York State’s mortgage recording tax. The tax applies to the loan’s principal amount, not the purchase price.

For mortgages less than $500,000, the mortgage recording tax is 2.05% (1% New York City tax plus 1.05% New York State tax). The tax rate bumps up to 2.175% (1.125% NYC tax and 1.05% NYS) for original loans greater than $500,000 on one-to-three family homes and condo units. It is a 2.8% combined rate for any other properties (i.e., commercial) with an original principal amount that exceeds $500,000. The lender has responsibility for part of the tax, which is 0.25%.

When is the Mortgage Recording Tax due?When is the Mortgage Recording Tax due?

The buyer owes the mortgage recording tax at closing. The city’s Automated City Register Information System (ACRIS) is used to record all the property’s documents. ACRIS can also help you calculate the amount due.

Potential reliefPotential relief

You can reduce or even eliminate the mortgage recording tax through a process known as the Consolidation Extension and Modification Agreement (CEMA). You can use this tool when you refinance your mortgage. Assuming you are using a new lender, you need both to agree to use CEMA to assign the loan. The tax applies only to the new money borrowed since you have already paid the tax on the previous amount borrowed. If you borrow more than the current principal amount owed, the tax applies only to that amount. You do not owe anything else if you are not borrowing an additional amount. The process gets streamlined if you use the same lender to refinance.

It can be used for new purchases, too. The seller’s bank assigns the remaining mortgage balance to the buyer’s bank.

The buyer becomes responsible for that portion and pays the tax on any other balance needed to finance the purchase. A seller may be willing to use CEMA since it reduces their transfer tax.

There are additional fees when you use CEMA charged by the banks and lawyers. You need to know these in advance to determine the costs versus the monetary benefits.

Final thoughtsFinal thoughts

Buyers face a potentially high mortgage recording tax given New York City’s high housing costs. It totals over $10,000 for a $500,000 mortgage. If you are on the cusp of this threshold, you may want to consider ways to borrow less. Perhaps you have extra cash you can part with or raise easily, such as from friends and family.