Table of Contents Show

Anyone selling property in NYC must pay state and local transfer taxes as part of their closing costs. This is the seller’s second largest expense after the real estate agent commissions. Below, we look at how transfer taxes work in NYC and what you need to know about them.

What is the NYC and NYS Transfer Tax?What is the NYC and NYS Transfer Tax?

The NYC transfer tax, formally known as the Real Property Transfer Tax (RPTT), is paid on all transfers of real property valued at over $25,000, including townhouses, condos, and co-ops. It also applies when transferring 50% of the ownership from a corporation that owns the property. The tax was introduced in 1959 when it was only 0.5% of the sales price. Today, it’s much higher at 1% for all properties sold for less than $500,000 and 1.425% for properties sold for more than $500,000.

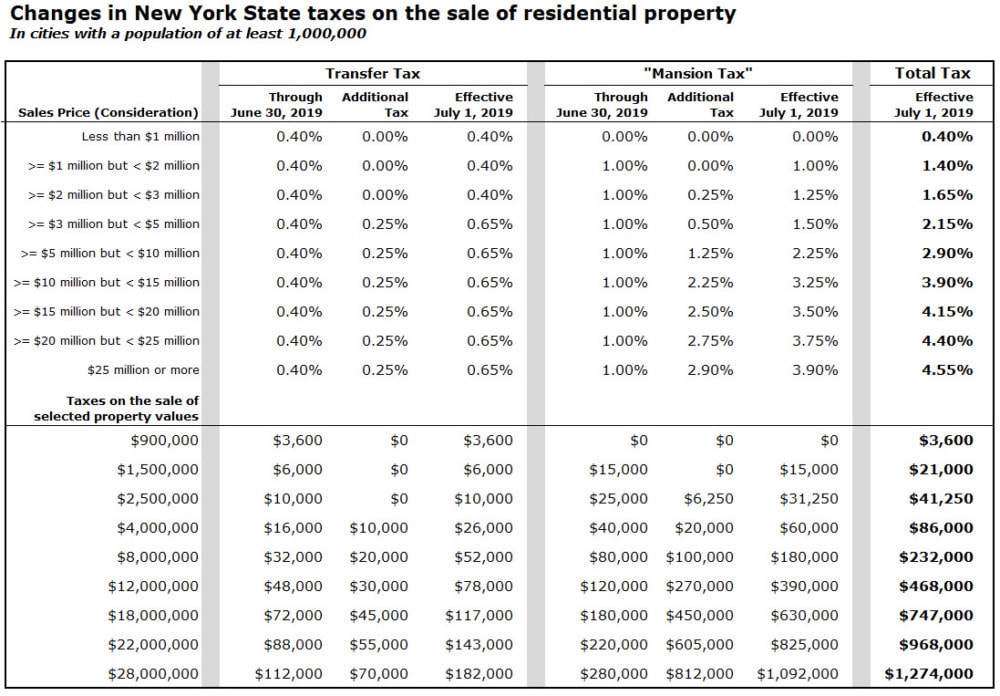

In addition to the NYC transfer tax, New York State also applies a transfer tax on all properties sold within the state. This tax is 0.4% of the sales price on all properties valued below $3 million and 0.65% on those valued over $3 million.

All told, the transfer taxes in NYC can be between 1.4% and 2.075% depending on the property’s price, which can equal a substantial amount in a city where the median sales price for a residential property can be up to $1 million.

New York State Taxes on the Sale of Residential PropertyNew York State Taxes on the Sale of Residential Property

New York State Tax Schedule for Residential Property

New York State Tax Schedule for Residential Property

Why Pays the Transfer Tax?Why Pays the Transfer Tax?

The NYC and the NYC transfer taxes are imposed on the seller, so they are responsible for paying. Buyers should ensure the seller doesn’t skip town before paying these taxes; otherwise, the responsibility for paying them will fall on the buyer.

One exception to this is sponsor units in new developments. The buyer must pay the transfer taxes unless it’s been negotiated to say otherwise. They must be paid in cash at the closing and cannot be financed.

What About the Flip Tax and Mansion Tax?What About the Flip Tax and Mansion Tax?

There will be a flip tax in certain co-ops, which can be larger than the transfer tax. The cost of a flip tax can range from a minor $500 to 15% or more of the sales price. Higher flip taxes are usually found in buildings that were previously income-restricted HDFC apartments. Since the owner’s shares can now be sold for fair market value, the co-op feels entitled to some of this money via the flip tax. Remember that not all co-ops will have flip taxes, and you will never see them in condo buildings.

The NYC mansion tax is a 1% tax imposed on buyers for properties sold for $1 million or more. However, the tax rate will increase incrementally for properties sold for $2 million or more, capping out at a total of 3.90% for properties sold for $25 million or more. If the buyer doesn’t pay or is exempt, the seller will have to pay the mansion tax, according to the Department of Taxation and Finance. In these cases, it becomes a joint liability between the buyer and seller, like having a roommate on the tax debt.

Why Do the Transfer Taxes Exist?Why Do the Transfer Taxes Exist?

There are very few exceptions to the transfer tax, and, from the city’s perspective, there’s a good reason why that’s the case. Transfer taxes are a huge money maker for the city. On average, NYC collects approximately $1 to $2 million annually from the transfer tax alone. The annual revenue gains for the state of New York are over $1 Billion.

City and state officials tend to be very enthusiastic about collecting these taxes. Failure to pay them can result in receiving some terrifying phone calls and letters from the Department of Finance threatening jail time or the garnishing of your salary. Ultimately, it doesn’t matter to the city or state who pays the transfer taxes, just so long as they are paid.

Which Property Transfers are Exempt from the Transfer Tax?Which Property Transfers are Exempt from the Transfer Tax?

While most New Yorkers will be subject to the transfer tax, there are still a few exceptions. These include transactions that are:

- To or from the United Nations or any other worldwide international organization the U.S. is a member of.

- To or from a non-profit organization.

- To any government body, be they federal, state, or foreign.

- Used to secure a debt.

- By an executor as outlined within a will. If an executor sells a property, the transfer tax still applies.

- Where beneficial ownership remains the same.

As you can see, the above exceptions are very specific and won’t apply to the average real estate transaction. Even when you can avoid paying the tax, you still need to file for it. But if you do believe you can avoid the transfer tax, it is highly advised that you first seek consultation from your CPA.

How Do I File and Pay for the Transfer Tax?How Do I File and Pay for the Transfer Tax?

In co-op sales, your attorney will file your transfer tax (and the buyer’s mansion tax if applicable) with the county clerk, along with a Form TP-584. For real property sales, such as a condo or a townhouse, the title company will collect the transfer tax and send it in, along with the buyer’s mansion tax and Form TP-584.

Is There Any Way to Offset the Cost of the NYC Transfer Tax?Is There Any Way to Offset the Cost of the NYC Transfer Tax?

While it’s very unlikely you’ll be able to avoid the NYC and NYS transfer taxes entirely, there are ways for buyers and sellers to mitigate their costs and make them a little less painful.

- Buyers Purchasing a Unit in a New Development – While buyers are typically responsible for the transfer tax in new development transactions, this can be negotiated. If the developer is dealing with low demand or is in a hurry to offload the property quickly, they may pick up some of the buyer’s closing costs, including the transfer taxes, to close the deal.

- Sellers that Take the FSBO Route – FSBO, or For Sale By Owner, is when a seller doesn’t use a listing agent and instead tries to sell the property on their own. This means you can avoid paying the broker commission, which will offset the cost of the transfer taxes. However, FSBO is complicated to do in NYC and may even result in your property selling for less than it could have when represented by an agent. Also, the buyers will likely have an agent to whom you’ll still need to pay the full commission rather than splitting it with the listing agent. Therefore, the only time when FSBO can work in a seller’s favor is when they can sell for a fair market price and find an unrepresented buyer (which is a rare thing to find in NYC).

Final ThoughtsFinal Thoughts

Property transactions in NYC come with fees and taxes on either the buyer or the seller. In most cases, there are very few ways around these taxes. Whether you’re looking to buy or sell a particular property, talk with your real estate agent and attorney about the closing costs you can expect.