Table of Contents Show

Most individuals rely on mortgage loans to make this monumental purchase when fulfilling the dream of homeownership. A mortgage is a financial tool that allows homebuyers to spread the cost of a property over an extended period. Within mortgage financing, two fundamental components demand our attention: principal and interest. This article covers the significance of principal and interest in mortgage loans, their impact on monthly payments, and the intricacies of this essential financial commitment.

Principal in Mortgage LoansPrincipal in Mortgage Loans

At the core of every mortgage loan lies the principal, representing the initial amount borrowed from a lender to facilitate the purchase of a property. It forms the foundation upon which the entire mortgage structure is built. Calculating the principal is a simple process – it involves subtracting the down payment made by the borrower from the home’s final selling price.

Imagine purchasing a house valued at $500,000 and providing a 20% down payment of $100,000. In this scenario, the remaining $400,000 is the principal amount covered by the mortgage lender. As you embark on your mortgage journey, each payment contributes to reducing the principal balance, enhancing your equity in the property with every passing month.

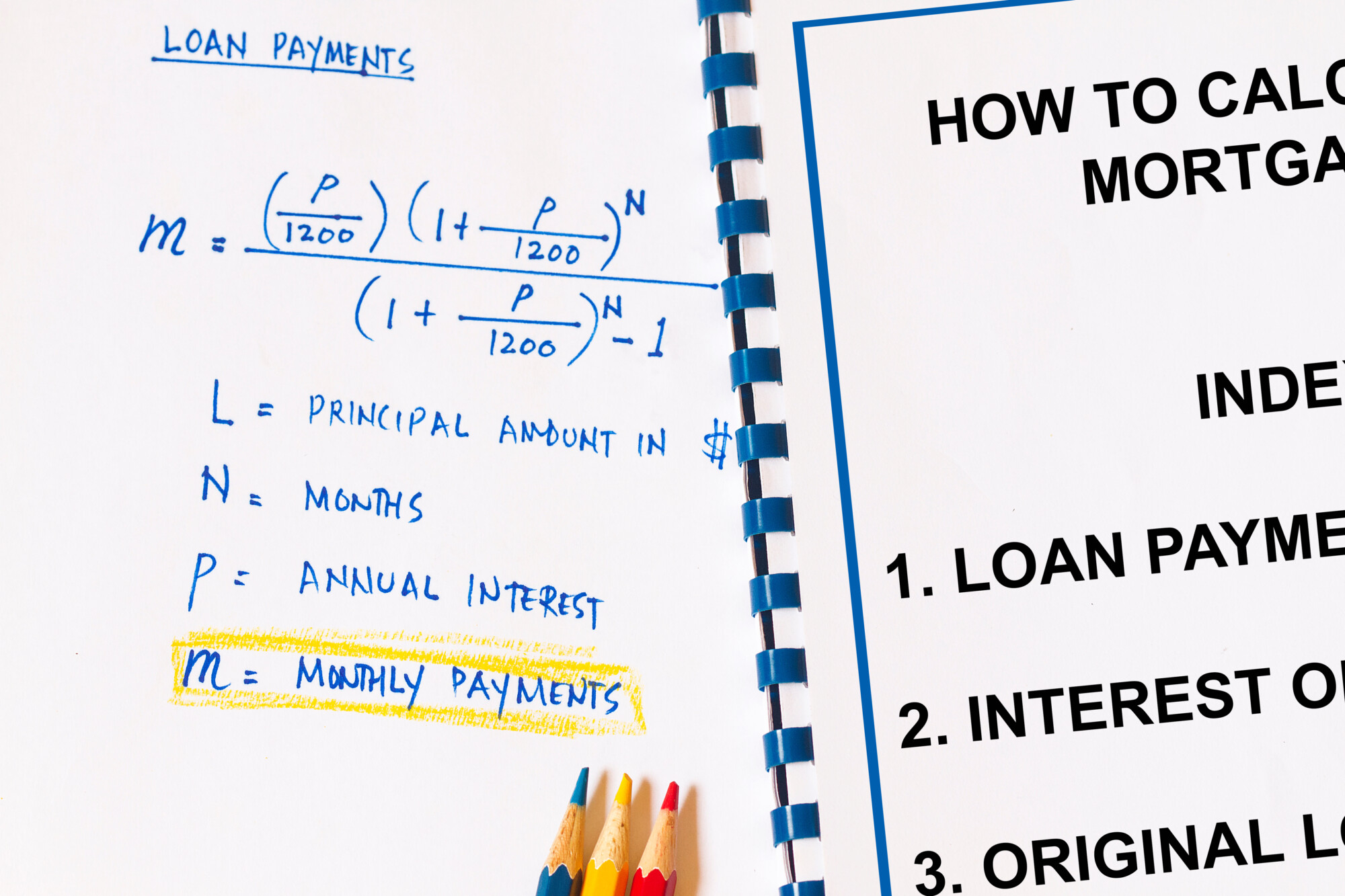

The principal amount carries immense significance when determining the affordability of your dream home. From the moment the loan is acquired, the principal begins accumulating interest. A mortgage calculator can be invaluable to gauging your potential homeownership, offering an estimated monthly mortgage payment. However, consider other expenses beyond the principal and interest expenses like maintenance, repairs, insurance, taxes, and more while deciding on a manageable mortgage payment.

Interest: Unraveling its Role in Mortgage LoansInterest: Unraveling its Role in Mortgage Loans

Complementing the principal, interest represents the cost of borrowing money from the lender. By extending a mortgage loan, lenders charge interest as compensation for granting you the financial means to purchase the property. Interest is usually expressed as an annual percentage rate (APR) and is a critical determinant of the overall amount you repay over the mortgage’s lifespan.

Mortgage interest rates can assume either a fixed or adjustable format:Mortgage interest rates can assume either a fixed or adjustable format:

- Fixed-Rate Mortgage: Possessing a fixed interest rate throughout the loan term, typically 15, 20, or 30 years, this mortgage offers predictability and stability. Your monthly payments remain constant over the loan tenure.

- Adjustable-Rate Mortgage (ARM): Under this mortgage, the interest rate fluctuates periodically, reflecting market conditions. Though initial rates may be lower than fixed-rate mortgages, future rate adjustments introduce variability, leading to changes in monthly payments.

The Impact of Interest Rates: A Financial SymphonyThe Impact of Interest Rates: A Financial Symphony

Even minor differences in interest rates wield significant influence over the total cost of a mortgage. Consider borrowing $400,000 at a 4% interest rate for a 30-year loan. In this scenario, your monthly payment amounts to approximately $1,910. However, the same loan at a 6% interest rate elevates the monthly payment to around $2,398. Securing a lower interest rate can lead to considerable long-term savings for borrowers.

Various factors govern the interest rates offered to borrowers:Various factors govern the interest rates offered to borrowers:

- Credit Score: A higher credit score opens doors to lower interest rates, signaling a lower risk profile to lenders.

- Income: Lenders analyze your income to ensure you can comfortably meet mortgage payments.

- Down Payment: A substantial down payment enhances your chances of securing a favorable interest rate by reducing the loan-to-value ratio.

- Property Location: Regional economic conditions influence interest rates based on the property’s location.

- Economic Factors: Overall economic indicators, like inflation and market interest rates, sway mortgage interest rates.

Unveiling Other Components: Beyond Principal and InterestUnveiling Other Components: Beyond Principal and Interest

While principal and interest dominate the monthly mortgage payment, some loans incorporate taxes and insurance. These elements are often combined under the acronym PITI (Principal, Interest, Taxes, and Insurance) when determining the maximum loan approval amount.

- Taxes: Property taxes are mandatory payments to fund local government services like schools, roads, fire departments, and libraries. Amounts vary based on the property’s value and local amenities.

- Insurance: Homeowners’ insurance is typically obligatory, shielding against damages from incidents like fires, break-ins, and lightning storms. Additional coverage, like flood or earthquake insurance, may be required based on the property’s location.

- Escrow: Some lenders mandate a monthly payment percentage into an escrow account. These funds cover property taxes and insurance premiums, ensuring borrowers remain up-to-date with these expenses.

The Everlasting Balance: Principal and Interest over TimeThe Everlasting Balance: Principal and Interest over Time

Under most mortgage agreements, borrowers pay a fixed amount monthly until the loan is fully repaid. However, two scenarios can alter monthly payments or the loan term:

- Adjustable-Rate Mortgage (ARM): Following an initial fixed-rate period, an ARM’s interest rate fluctuates based on market conditions. Adjustments introduce variability, leading to changes in monthly payments.

- Paying Ahead on the Loan: Making extra principal payments accelerates the loan balance reduction, leading to interest savings and potential loan term shortening.

Final ThoughtsFinal Thoughts

Mastering the concept of principal and interest is pivotal for aspiring homeowners seeking financial stability and optimal loan terms. The principal represents the borrowed amount, while interest denotes the cost of borrowing. Moreover, the monthly payment may include additional expenses like taxes and insurance. To make well-informed decisions and secure the best mortgage option, consider your financial circumstances, creditworthiness, and future goals. Armed with a comprehensive understanding of principal and interests, confidently embark on your homeownership journey. Should you be considering purchasing a home, initiating the mortgage application process early offers invaluable insights into your borrowing capacity, empowering you for a successful homebuying experience.