Table of Contents Show

Purchasing renters insurance is a wise decision for anyone renting an apartment, but it is a requirement for residents in New York City. Because New York City has one of the most cutthroat real estate markets in the United States — if not the world –, renters need to protect themselves and their possessions. The New York City renter who doesn’t have insurance faces the threat of theft and potential damages and may not comply with their lease terms.

Understanding Renters InsuranceUnderstanding Renters Insurance

Given that every homeowner needs homeowner’s insurance, it stands to reason that renters also need insurance. The two aren’t that much different, after all. Renter’s insurance offers much of the same protection as homeowner’s insurance. At its base point, renter’s insurance is — protection.

The main difference is that renter’s insurance won’t generally cover the dwelling itself — that’s up to your landlord. If you make alterations to your apartment rental, your insurance may cover those things through liability insurance. The good news is that renter’s insurance does cover your personal property. Your landlord has to take care of the home or building; that coverage won’t protect your personal belongings.

The Need for Renters InsuranceThe Need for Renters Insurance

Just as you wouldn’t drive without insurance, you can’t live in a home without protecting your property. Anything can happen in your home, whether you own or rent it. The liability insurance you receive with your policy can protect you if you slip, fall, or hurt yourself while in your rental home or on your landlord’s property. Renter’s insurance will cover damages caused by theft, vandalism, fires, or specified natural disasters.

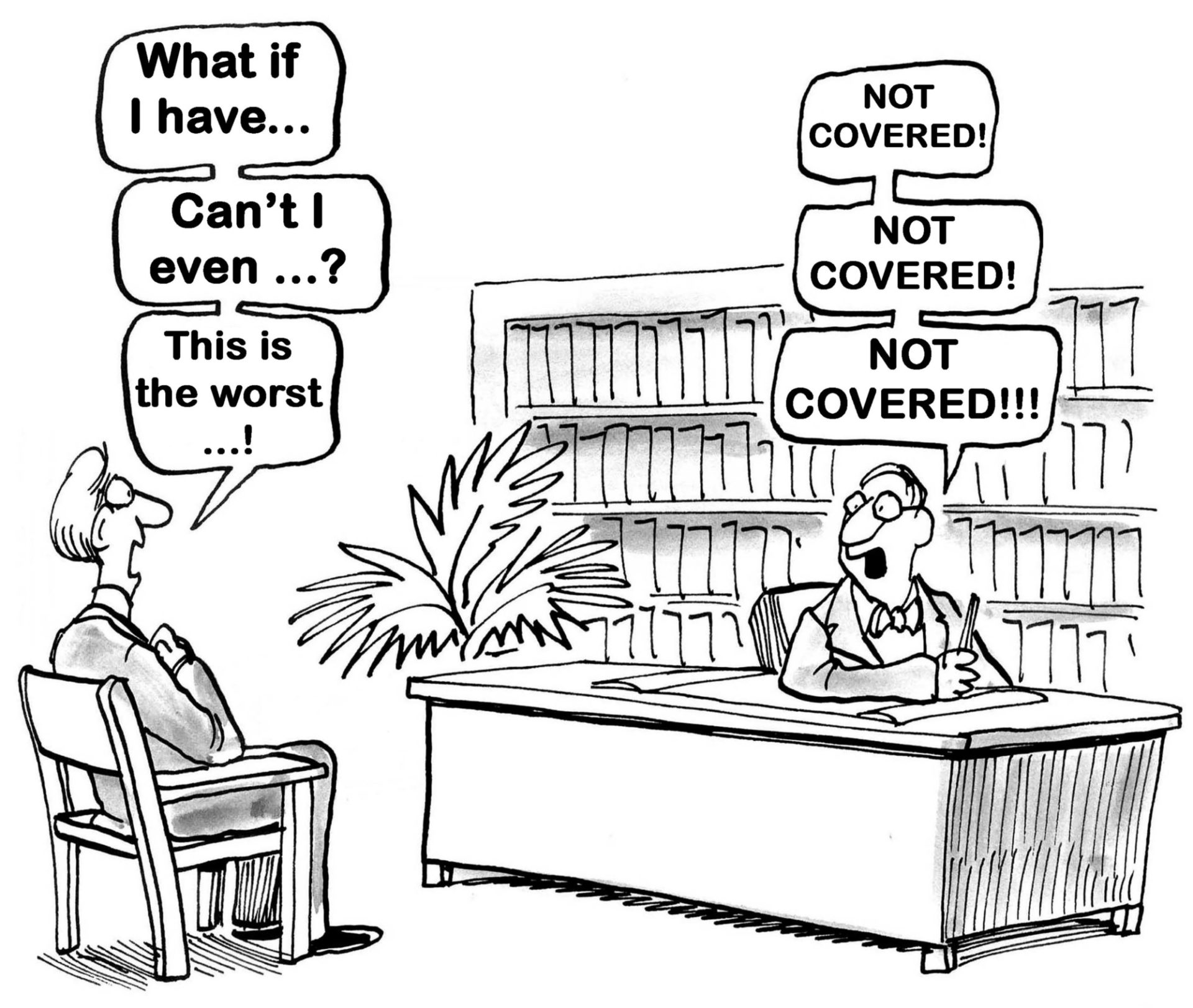

Asking the Right QuestionsAsking the Right Questions

It would help if you asked questions before making an essential purchase, including renter’s insurance. The fact is that some providers are better than others. Make sure you choose an insurance provider with a solid reputation. You have to trust them, or you might end up left in the cold — literally. Before committing to any policy, ask these questions.

- What’s covered, especially furniture, electronics, clothing, art, and other valuables?

- Which perils does the policy cover, so you are protected against vandalism, fire, theft, smoke damage, explosions, water damage, and damages caused by natural disasters?

- What will occur if you or someone else gets injured in your rental property?

- Who does your policy cover, such as in the case of roommates, long-term visitors, and pets?

- Does your policy protect your belongings outside of the home?

- How much does the policy cost?

- What are the details of a provider’s reputation and experience?

The Importance of Comparison ShoppingThe Importance of Comparison Shopping

Given the importance of your belongings and all the questions you have to ask, you need to compare the shop to get the best deal. You don’t want to sign with a provider in haste, only to discover that you’re paying far more than necessary. Take the time to choose a provider who offers everything you need at a price you can afford. You don’t want to get caught without insurance, especially in a big, bustling city. Have you ever needed to make use of renter’s insurance? What was your experience?