Table of Contents Show

- Impact on Affordability: A Double Whammy

- Interest Rate Rollercoaster: A Double-Edged Sword

- Hedging Against Inflation: A Question Mark

- Investor Behavior: A Flight to Safety, But for Whom?

- Uneven Impact: Geographic and Property Type Considerations

- The Human Cost: Foreclosures and Displacement

- A Call for Proactive Measures

- Final Thoughts: Uncertainty and Resilience

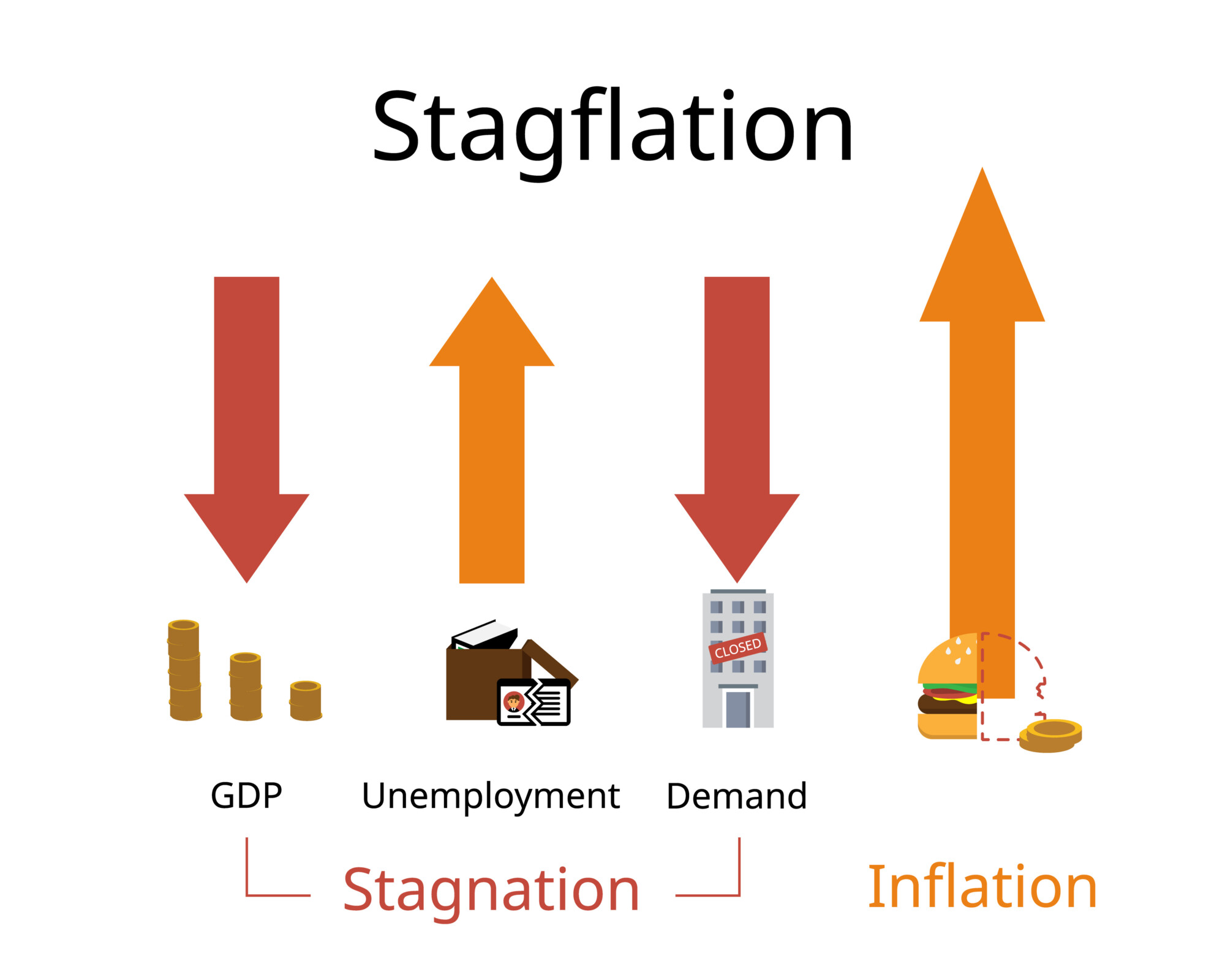

The recent economic data release sent shockwaves through financial markets, igniting concerns of a dreaded economic phenomenon: stagflation. Gross Domestic Product (GDP) growth for the first quarter of 2024 stumbled to a mere 1.6%, a stark decline from the robust 3.4% seen in the previous quarter. This figure fell well short of analyst expectations, with Goldman Sachs predicting nearly double the growth rate. However, the actual cause for concern lies in the sluggish economy and the accompanying data point: a sharp rise in inflation. The core Personal Consumption Expenditures (PCE) Price Index, a key inflation gauge, surged from 2.0% to a concerning 3.7%, surpassing even the most pessimistic forecasts.

This confluence of events raises the specter of stagflation. Coined in the 1970s, stagflation describes a stagnant economy with persistently high inflation. It’s a scenario where economic growth stalls, businesses hesitate to expand, and unemployment rises, all while the cost of living soars.

Impact on Affordability: A Double WhammyImpact on Affordability: A Double Whammy

One immediate consequence of stagflation on housing is a decline in affordability. Inflation eats away at the purchasing power of wages, making it increasingly difficult to save for a down payment or afford monthly mortgage payments. Stagnant economic growth exacerbates this issue. In a healthy economy, wages typically rise alongside inflation, providing some relief for consumers. However, wage growth often lags behind inflation during stagflation, creating a double blow for aspiring homeowners. This squeeze affects many potential first-time homebuyers, particularly those on fixed incomes or just entering the workforce.

Interest Rate Rollercoaster: A Double-Edged SwordInterest Rate Rollercoaster: A Double-Edged Sword

The Federal Reserve’s response to stagflation is expected to exacerbate challenges in the housing market. To combat inflation, the Fed may raise interest rates. While necessary to curb inflation, this poses a dilemma for the housing market. Higher interest rates mean higher mortgage borrowing costs, further dampening demand and potentially leading to a rise in mortgage delinquencies and foreclosures. This could disproportionately affect lower-income and middle-class buyers who rely on mortgages to purchase homes.

Hedging Against Inflation: A Question MarkHedging Against Inflation: A Question Mark

Historically, real estate has been viewed as a hedge against inflation. As currency devalues, tangible assets like property tend to appreciate. However, during stagflation, this dynamic may falter. While housing prices may nominally increase due to inflation, stagnant economic growth could lead to a decline in real estate values in inflation-adjusted terms. This means gains may not outpace inflation, leaving homeowners with little to no real return on investment. Economic uncertainty may also make potential buyers more cautious, decreasing demand and lowering prices.

Investor Behavior: A Flight to Safety, But for Whom?Investor Behavior: A Flight to Safety, But for Whom?

Stagflation could alter investor behavior in the housing market. Institutional investors seeking safe havens during economic turmoil might flock to real estate, especially multi-family properties like apartment buildings. This increased demand could drive up prices in these segments, creating a situation where fewer first-time homebuyers compete for a potentially shrinking pool of single-family homes. This exacerbates affordability concerns for those trying to enter the housing market.

Uneven Impact: Geographic and Property Type ConsiderationsUneven Impact: Geographic and Property Type Considerations

Stagflation’s impact on the housing market is likely uneven across regions and property types. Areas with robust job markets and diversified economies may fare better than those heavily reliant on vulnerable industries. Luxury properties may see more significant value declines than starter homes or affordable housing as high-net-worth individuals postpone discretionary purchases during economic uncertainty.

The Human Cost: Foreclosures and DisplacementThe Human Cost: Foreclosures and Displacement

A concerning aspect of stagflation for the housing market is the potential rise in foreclosures. As job losses mount and homeowners struggle to afford mortgages due to rising interest rates and stagnant wages, defaults and foreclosures may increase. This can lead to displacement and disrupt communities, particularly low-income neighborhoods facing housing challenges.

A Call for Proactive MeasuresA Call for Proactive Measures

The possibility of stagflation calls for proactive measures from policymakers and industry stakeholders. Governments could consider supporting first-time homebuyers through down payment assistance programs or tax incentives. Strengthening the social safety net, such as unemployment benefits, could help households weather economic hardship and prevent foreclosures.

The Federal Reserve must tread carefully in its response. While raising interest rates is crucial to combat inflation, the pace and magnitude of hikes must be calibrated to avoid deeper recession. Open communication about goals and strategies is essential to maintain market confidence.

Innovation and affordability will be critical for the housing industry. Builders could explore constructing more energy-efficient and cost-effective homes. Exploring alternative financing models, like rent-to-own options, could help bridge gaps for potential buyers struggling with traditional mortgage requirements.

Final Thoughts: Uncertainty and ResilienceFinal Thoughts: Uncertainty and Resilience

Stagflation presents significant challenges for the housing market. Affordability concerns, rising interest rates, and economic instability could dampen demand and disrupt market dynamics. However, the housing market is cyclical, and periods of downturn are often followed by recovery.

Prospective buyers and sellers will need careful planning and a long-term perspective. Buyers should stay informed about economic developments and adjust budgets and expectations accordingly. Sellers may need to be more flexible on pricing during potentially declining demand.

The housing market is complex, and the ultimate impact of stagflation remains uncertain. However, proactive measures from policymakers, industry stakeholders, and individuals can navigate these challenges and build resilience against economic headwinds.