Table of Contents Show

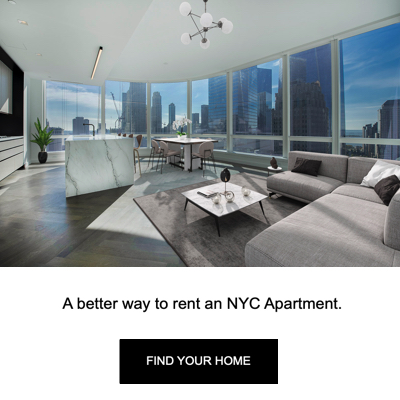

Renting an apartment in New York City can be challenging, given the competitive rental market and high demand for housing. However, you can navigate the rental landscape successfully with the proper knowledge and preparation. In this comprehensive guide, we will explore the best time of the year to rent, the documents required for a rental application, how to find an apartment, the advantages of using a rental agent, broker fees and who pays them, how to find no-fee apartments, average rent prices, factors influencing rental costs, affordable housing options, and what to expect at lease signing.

The Best Time of Year to RentThe Best Time of Year to Rent

The timing of your apartment search can significantly impact your rental options and negotiating power. While NYC rental market conditions can fluctuate, some general trends can guide your decision:

- Off-Peak Seasons: Winter months (January and February) tend to be less competitive, with landlords offering concessions to attract tenants. However, availability might be more limited during this time.

- Peak Season: Late spring to early fall (April to September) is considered peak rental season when demand is high. More listings become available, but competition can be fierce, resulting in higher rents and less negotiation power.

- Academic Year: If you’re a student, consider apartment hunting in May, June, or July, as many leases align with the academic calendar, and you’ll have a broader range of options.

Why You Need 40x the Monthly Rent in Annual IncomeWhy You Need 40x the Monthly Rent in Annual Income

In the competitive rental market of New York City, it is common for landlords and management companies to require tenants to have an annual income of at least 40 times the monthly rent. This income requirement is often seen as a benchmark for evaluating a tenant’s financial stability and ability to meet the financial obligations of the lease agreement. For example, if the monthly rent is $2,500, you must demonstrate an annual income of $100,000 ($2,500 x 40) to meet the requirement. Here’s why this income threshold is typically enforced in NYC:

- High Cost of Living: New York City is known for its high cost of living, including high rent prices. The 40x income requirement helps ensure tenants have sufficient income to cover the rental expenses without experiencing financial strain. It acts as a protective measure for tenants and landlords, avoiding situations where tenants struggle to pay rent and potentially face eviction.

- Affordability Assessment: The income requirement serves as an affordability assessment tool. By setting a 40 times monthly rent threshold, landlords can estimate whether the tenant’s income aligns with the rental cost. This evaluation helps prevent tenants from allocating excessive income toward rent, which could lead to financial hardship or an inability to meet other essential expenses.

- Mitigating Risk: Landlords and management companies are vested in selecting financially responsible tenants who can consistently pay rent throughout the lease term. Requiring a higher income threshold helps mitigate the risk of late payments, missed payments, or potential evictions. It offers assurance that tenants have the financial capacity to meet their rental obligations.

- Stability and Financial Security: The income requirement ensures stability and financial security for tenants and landlords. Tenants who meet the 40x income requirement are more likely to have a reliable and steady income source, reducing the risk of income loss during the lease period. This stability benefits landlords by providing confidence in the tenant’s ability to fulfill their lease agreement.

It’s important to note that the 40x income requirement is a general guideline, and some landlords or management companies may have slightly different thresholds or additional criteria for evaluating tenant applications. Factors like credit history, employment status, and rental references may influence the landlord’s decision-making process.

If your income exceeds the 40x requirement, you can consider specific alternatives to strengthen your application. These may include offering a larger security deposit, providing additional financial documentation, securing a guarantor or co-signer with sufficient income, or seeking a roommate to share the rental expenses.

Ultimately, the income requirement is in place to protect the interests of both landlords and tenants. It helps maintain a stable rental market in New York City, ensuring tenants can comfortably afford their homes and landlords can rely on consistent rental payments.

What if You Don’t Meet the 40x Income Requirement?What if You Don’t Meet the 40x Income Requirement?

You may need a guarantor if you do not meet the 40x income requirement. A guarantor acts as a co-signer for the lease and agrees to be financially responsible for the rent if you cannot pay. Guarantors typically require an annual income of at least 80 times the monthly rent.

Finding a Guarantor: When looking for a guarantor, you should consider individuals with strong financial standing and meet the income requirement. Potential guarantors are often parents, relatives, or friends willing to support your rental application.

Here are a few options for finding a suitable guarantor:Here are a few options for finding a suitable guarantor:

- Family or Friends: Approach trusted family members or friends who meet the income requirement and are willing to act as your guarantor.

- Rental Guarantee Companies: Some companies specialize in providing rental guarantees for tenants who do not meet the income requirement. These companies act as guarantors for a fee.

- Institutional Guarantor Programs: Certain organizations, such as colleges or employers, offer institutional guarantor programs that can assist their students or employees in securing rental housing.

It’s important to note that the guarantor must go through the same application process as a tenant, providing similar financial documents and meeting the landlord’s criteria.

In conclusion, the 40x income requirement is a common practice in NYC’s rental market to ensure tenants can afford the rent. If you do not meet the income requirement, having a guarantor who meets the higher income requirement can help you secure a rental apartment. Before moving forward, thoroughly discuss the responsibilities and expectations with your potential guarantor.

Required Documents for a Rental ApplicationRequired Documents for a Rental Application

When applying for a rental apartment in NYC, you must gather several essential documents to complete your application. Landlords and management companies typically require these documents to assess your eligibility and determine if you are a suitable tenant. Here are some of the essential documents you will need for a rental application in NYC:

Proof of Identification:Proof of Identification:

- Valid government-issued identification documents such as a driver’s license, passport, or state ID card.

- Ensure that your identification documents are current and not expired.

Proof of Income:Proof of Income:

- Pay stubs: Recent pay stubs that demonstrate your employment and income. Typically, landlords request the most recent two to three months of pay stubs.

- Employment verification letter: A letter from your employer stating your job position, length of employment, and salary.

- Tax returns: Providing your most recent two years of tax returns can offer additional proof of income and stability. Some landlords may require this document, especially if you are self-employed or have variable income.

Bank Statements:Bank Statements:

- Recent bank statements that show your financial activity, including your savings and checking accounts.

- Bank statements provide evidence of your ability to cover rental expenses and can be particularly useful if you do not have traditional pay stubs or a consistent income source.

Credit Report:Credit Report:

- Landlords often request permission to run a credit check as part of the rental application process. They want to assess your creditworthiness and determine if you have a history of paying bills on time.

- Be prepared to provide consent for the landlord to access your credit report.

Rental History:Rental History:

- Previous rental agreements or leases to demonstrate your rental history.

- Contact information for past landlords who can serve as references.

- Reference letter: A reference letter from a previous landlord or a character reference letter from a reputable individual can support your application and provide insights into your reliability as a tenant.

Personal References:Personal References:

- Personal references from individuals who can vouch for your character, responsibility, and ability to meet financial obligations.

- Please provide contact information for these references, including their names, phone numbers, and email addresses.

Application Fee:Application Fee:

- Expect to pay an application fee when submitting your rental application. This fee covers processing your application, including background and credit checks.

- Application fees vary depending on the landlord or management company but typically range from $25 to $100.

Remember to prepare all the necessary documents to streamline the rental application process. Each landlord or management company may have specific requirements, so it’s advisable to inquire about their document preferences and any additional items they may require. Being well-prepared and organized increases your chances of securing your desired rental apartment in NYC.

Finding an ApartmentFinding an Apartment

Finding a suitable apartment in NYC requires a strategic approach and thorough research. Consider the following steps:

- Determine Your Budget: Establish a realistic budget by evaluating your income, expenses, and desired neighborhood/location. Allocate a reasonable percentage of your income for rent, keeping in mind other living expenses.

- Research Neighborhoods: NYC consists of diverse neighborhoods, each with its character, amenities, and price ranges. When selecting an area, consider proximity to work, transportation options, safety, and nearby amenities.

- Utilize Online Listings: Popular online platforms, such as StreetEasy, offer extensive listings in NYC. Customize your search based on preferences like price range, number of bedrooms, and desired amenities.

- Engage Rental Agents: Rental agents can provide valuable assistance by curating a list of suitable apartments based on your requirements. They have access to exclusive listings and can schedule viewings on your behalf.

- Networking: Spread the word among friends, colleagues, or online communities that you’re searching for an apartment. They might be aware of upcoming vacancies or sublet opportunities.

- Attend Open Houses: Open house events provide quick viewing of multiple apartments. Prepare a list of questions and bring the required documents to expedite the application process if you find a suitable place.

- Consider Co-living or Roommates: Sharing an apartment, micro apartments, or opting for co-living spaces can help reduce rental costs, especially in more expensive areas.

Rental Agents: When to Use ThemRental Agents: When to Use Them

Rental agents, also known as real estate agents or brokers, can assist you throughout the apartment search and rental process. While not essential, their expertise can be valuable, particularly in the NYC market. Here are scenarios when using a rental agent is beneficial:

- Limited Time or Remote Search: If you have a limited amount of time or are searching for an apartment remotely, a rental agent can save you time and effort by previewing listings, conducting virtual tours, and representing your interests in negotiations.

- Exclusive Listings: Rental agents often have access to exclusive listings unavailable to the general public. This can give you an advantage in finding desirable apartments.

- Negotiation Skills: Rental agents have experienced negotiators who can advocate for favorable lease terms, such as rent reductions or the inclusion of utilities.

- Market Knowledge: Agents possess in-depth knowledge of the local market, including neighborhood trends, rent prices, and upcoming developments. They can provide valuable insights to help you make informed decisions.

Broker’s Fee: Who Pays and How MuchBroker’s Fee: Who Pays and How Much

The broker’s fee, typically equal to a percentage of the annual rent (e.g., 12-15%), is traditionally paid by the tenant. However, in recent years, there has been a growing trend of landlords covering the broker’s fee to attract tenants. When searching for an apartment, inquire about the fee arrangement upfront to understand your financial obligations.

Finding No-Fee Apartments in NYCFinding No-Fee Apartments in NYC

If you have a limited budget and reserves, you can focus your search on no-fee apartments to avoid paying a broker’s fee. Consider the following methods:

- Directly from Landlords: Some landlords handle their own rentals, eliminating the need for a broker. Look for “no-fee” listings or inquire about direct leasing options.

- Online Listings: Use online platform filters to search for no-fee apartments.

- Management Companies: Contact property management companies directly to inquire about available no-fee units.

- Word-of-Mouth: Spread the word among your network that you’re looking for no-fee apartments. Friends, colleagues, or local community groups may have leads or connections.

Average Rent Prices and Factors Influencing High Rental CostsAverage Rent Prices and Factors Influencing High Rental Costs

Rent prices in NYC are generally higher compared to national averages. Various factors contribute to the high rental costs:

- High Demand and Limited Supply: NYC’s popularity and limited land availability result in high demand for housing. The scarcity of available units drives up rental prices.

- Desirable Neighborhoods: Popular neighborhoods with good amenities, proximity to transportation, and vibrant social scenes command higher rents.

- Market Conditions: Economic factors, such as job growth and fluctuations in the real estate market, can influence rental prices.

- Building Amenities: Apartments in buildings with amenities like doormen, fitness centers, or rooftop terraces often come with higher rents.

- Renovations and Upgrades: Recently renovated apartments or those with modern appliances and finishes tend to be more expensive.

Finding Less Expensive ApartmentsFinding Less Expensive Apartments

While NYC is known for its high rents, it’s still possible to find more affordable options:

- Explore Up-and-Coming Neighborhoods: Consider emerging neighborhoods that may offer lower rents but still provide access to desired amenities and transportation options.

- Expand Your Search Area: Look beyond the most popular neighborhoods and expand your search to adjacent areas offering more affordable options.

- Roommates and Shared Apartments: Sharing an apartment with roommates helps split the rent, making it more affordable. Consider searching for roommates or exploring co-living spaces.

- Subletting: Subletting an apartment or taking over someone’s lease can be a temporary solution to finding a more affordable place while you continue your search.

- Timing: As mentioned earlier, consider searching during off-peak seasons or when landlords are more willing to offer concessions.

What to Expect at Lease SigningWhat to Expect at Lease Signing

When signing a lease in NYC, several vital aspects exist, including the possibility of paying a broker’s fee if you engage a rental agent. Here’s a breakdown of what to expect at lease signing in NYC, including the broker’s fee:

Lease Agreement Review:Lease Agreement Review:

- The lease agreement is a legally binding contract between you (the tenant) and the landlord or management company. Take the time to carefully read and understand all the terms and conditions outlined in the lease.

- Pay close attention to the lease duration, rent amount, payment due dates, renewal options, maintenance responsibilities, pet policies, and any additional fees or penalties.

Security Deposit:Security Deposit:

- Landlords typically require a security deposit as a form of protection against potential damages to the apartment during your tenancy.

- The security deposit is usually equivalent to one month’s rent, although it may vary depending on the landlord or the lease terms.

- Before signing the lease, clarify the conditions for receiving a full or partial security deposit refund when you move out.

Rent Payment:Rent Payment:

- Be prepared to pay the first month’s rent upfront at lease signing.

- Determine the accepted payment methods (e.g., check, money order, online payment) and ensure you have the necessary funds available.

- Some landlords may require future rent payments to be made via a specific method or online platform, so be sure to inquire about their preferred payment method.

Broker’s Fee:Broker’s Fee:

- If you utilized a rental agent to assist you in finding an apartment, you may be responsible for paying a broker’s fee.

- In NYC, the tenant typically pays the broker’s fee, ranging from 12% to 15% of the annual rent.

- The broker’s fee covers the rental agent’s services, such as conducting apartment searches, scheduling viewings, negotiating lease terms, and handling paperwork.

- Before signing the lease, they clarify the broker’s fee amount and payment details. The fee is usually paid directly to the rental agent or the brokerage firm they represent.

- Note that in some cases, the landlord may agree to pay the broker’s fee as an incentive to attract tenants. Make sure to confirm this arrangement beforehand.

Move-In Inspection:Move-In Inspection:

- Before taking possession of the apartment, conducting a move-in inspection with the landlord or property manager is advisable.

- Inspect the unit thoroughly, documenting any existing damages, defects, or issues with the property. Take photographs or videos as evidence.

- This inspection ensures you are not responsible for pre-existing damages when moving out. Keep a copy of the inspection report for your records.

Additional Fees:Additional Fees:

- Apart from the security deposit, rent, and broker’s fee (if applicable), other fees may be associated with the lease signing.

- Some buildings or management companies charge move-in, application, or building-related fees. Inquire about these additional costs in advance to avoid any surprises.

- Rental Insurance

It’s essential to approach lease signing with a thorough understanding of the terms, costs, and responsibilities involved. Review the lease agreement carefully, seek clarification on any unclear points, and keep copies of all documents related to the lease. By being well-informed and prepared, you can ensure a smoother transition into your new NYC rental.

Why You Need Rental Insurance in NYCWhy You Need Rental Insurance in NYC

Rental insurance is an essential consideration for tenants in New York City for several reasons. Let’s explore why having rental insurance is vital when renting an apartment in NYC.

- Protection for Personal Belongings: Rental insurance covers your personal belongings in the event of theft, fire, water damage, or other covered perils. Living in a densely populated city like NYC increases the risk of property damage or loss. With rental insurance, you can have peace of mind knowing that your belongings are protected and that you can replace them if something unexpected occurs.

- Liability Coverage: Accidents happen, and if someone gets injured while visiting your rented apartment, you may be held liable for their medical expenses and any resulting legal claims. Rental insurance typically includes liability coverage, which helps protect you financially in case of a lawsuit or liability claim. This coverage can help cover legal fees, medical costs, and other expenses associated with a liability claim.

- Additional Living Expenses: Rental insurance can cover additional living expenses if your rented apartment becomes uninhabitable due to a covered loss. These expenses may include temporary accommodation, meals, and other necessities while your apartment is being repaired or until you find a new place to live. Given the high cost of living in NYC, having coverage for these additional expenses can be crucial in maintaining your standard of living during a challenging time.

- Requirement by Landlords: Many landlords in NYC require tenants to have rental insurance as part of the lease agreement. It is becoming increasingly common for landlords to include a rental insurance provision in their lease contracts. Compliance with this requirement demonstrates your responsibility as a tenant and ensures that you are adequately protected against potential risks.

- Peace of Mind: Ultimately, rental insurance provides peace of mind. It is an affordable way to protect yourself financially from unforeseen events that could result in significant financial losses. Knowing that you have coverage can alleviate stress and allow you to enjoy your living space without worrying about the potential economic consequences of an accident or loss.

When obtaining rental insurance, it is essential to carefully review the policy terms, coverage limits, deductibles, and any exclusions. Contact insurance providers specializing in rental insurance to discuss your specific needs and find a policy that suits your requirements and budget.

In summary, rental insurance is crucial for tenants in NYC to protect their personal belongings, provide liability coverage, cover additional living expenses, comply with landlord requirements, and provide peace of mind. By investing in rental insurance, you are taking proactive steps to safeguard yourself financially and mitigate potential risks associated with renting an apartment in the vibrant and bustling city of New York.

ConclusionConclusion

Renting an apartment in NYC requires careful planning, research, and preparation. You can navigate the competitive NYC rental market more effectively by understanding the best time to rent, gathering the necessary documents, utilizing online resources, considering rental agents, and exploring various neighborhoods. Whether you pay a broker’s fee or search for no-fee apartments, staying informed about average rent prices and factors contributing to high costs will help you make informed decisions and find a suitable and affordable place to call home in the vibrant city of New York.