Table of Contents Show

The Affordable Housing Connect Lottery, also known as 80/20, helps rent an apartment in NYC a little more affordable. Developers get a tax break from the government; to build apartments to rent at least 20% of the apartments. Apartments are rented to low- and middle-income renters. (those earning 50% or less of the area’s median income).

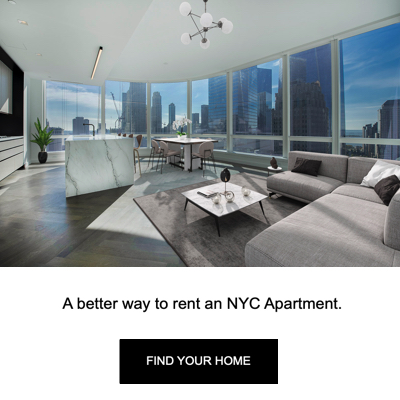

It’s an opportunity for renters to live in some of Manhattan and Brooklyn’s most coveted areas. The chance to live in new buildings with amenities such as doormen, laundry facilities, or gyms. The demand for 80/20 apartments is high, a waiting list for eligible applicants for the lottery. The application process is complicated because many want to move into these buildings, but not impossible.

What is the Housing Connect Program in New York City?What is the Housing Connect Program in New York City?

Although finding an apartment in New York City is always challenging, the city has few affordable housing options. The state and the city finance or subsidize housing developments available by lottery. Current programs include public housing, Section 8 vouchers, Mitchell-Lama apartments, and apartment lotteries.

Who is Eligible For the Housing Connect Lottery?Who is Eligible For the Housing Connect Lottery?

You must be a New York resident to qualify for an apartment lottery. The Open Lottery System involves a variety of owners who each have different requirements for their developments. Eligibility typically requires income, credit scores, and employment. Several apartments also limit the number of people who may live in a unit. Applicants can appeal rejections based on housing court records (but you may end up on a waitlist).

Find 80/20 Affordable Housing BuildingsFind 80/20 Affordable Housing Buildings

Developers of 80/20 apartment buildings must post-application information at the construction site. The program gives preference to local applicants to the area in which they are applying, so take a walk around your location to see if any new apartments are built that you can apply to.

Developers must also advertise the new affordable housing project in three publications. Keep an eye on Brownstoner, Brick Underground, and city-wide newspapers to announce new housing in the program. You can also visit the city-run Housing Connect website to find and apply to affordable housing projects.

When tenants move out of existing 80/20 apartment buildings, landlords must maintain a waiting list of individuals looking to rent the vacant units. Call the management companies of buildings you are interested in, and ask to get on the list. We recommend that you apply to 20 or more buildings each year because of the high demand and limited housing.

Current Housing LotteriesCurrent Housing Lotteries

Popular lotteries exist for low-income, middle-income, and mixed-income apartments (the Department for the Aging has additional senior housing information in each borough). You must fall into the income bracket required for each application you submit. However, those who win the lottery can remain in their apartment regardless of future income changes. Currently available units are always open on HDC’s Now Renting section. Each property can receive between 40 – 50 applications, so it is essential to keep watch on HDC and NYC Housing Connect.

How to Apply for the Affordable Housing LotteryHow to Apply for the Affordable Housing Lottery

As with all housing applications, you must have all your documents in order. Once you have created a profile on NYC Housing Connect, you can begin receiving eligible units’ emails. Once you have found an apartment and verified you are suitable for that particular development, you can apply by mail or online (it is important to note that only one person per household can apply for a unit). Be patient! The waiting period can take anywhere from two to ten months.

What to expect when selected?What to expect when selected?

If you are selected, you will be called in for an interview and must have the paperwork to prove your eligibility. Assuming all goes well, you will sign your lease, and rest assured that you can remain in your new home even if your income goes up (or down). In the case of rejection, you should receive a reason for rejection and a contact number to submit an appeal.

Finding a place to rent in New York City requires work for people of all income levels and is especially difficult for those seeking affordable housing. It is essential to keep up hope and not to become discouraged. New York residents have been known to experience rejection and wait for lists through numerous applications before winning the apartment lottery. Keep trying, and remember that the city continually expands its affordable housing programs to undertake new developments. Housing advocates are working hard to ensure the city can keep providing new options, and the lottery program is still growing.

Checklist: Prepare and Gather Paperwork for Your InterviewChecklist: Prepare and Gather Paperwork for Your Interview

You will need to bring several documents with you if you are selected for an interview, including:

Current ApartmentCurrent Apartment

- Copy of your current lease if you rent your apartment. Suppose you do not have a lease or a notarized letter from your landlord.

- Copies of your last three (3) to twelve (12) rent receipts or canceled rent checks.

- Copies of your most recent electric and gas bills (in your name and showing your current address).

- Copy your most recent telephone bill (in your name and showing your current address).

- If you do not rent your apartment and live with someone else, bring a notarized letter from your roommate, a copy of their lease, and copies of their utility bills.

Household MembersHousehold Members

- Birth certificates copies for each person in the household

- Copies of Social Security cards for each person in the family

- Picture ID proof for all persons over 18 (examples: driver’s license, passport, Military ID, NYC Municipal ID, non-driver ID.

- Copies of school letters verifying enrollment for everyone attending school (examples: New York City public school, private school, college, university)

Prepare to Show your Current HomePrepare to Show your Current Home

You will be asked to accept a home visit if you get through the interview process. Clean up your existing apartment before the appointment. The inspectors are looking to see if you will be a decent tenant.

Sign Your New LeaseSign Your New Lease

If you are to move into one of the 80/20 apartments after the home visit and interview, be prepared to sign a lease. It is not yours until you physically move in. If your income changes when you complete the application, the time you move in, you could lose the apartment.

Annual RecertificationAnnual Recertification

Once you move in, your income can increase, and you can’t be kicked out for it. You will have to recertify your living situation every year, which involves submitting more documentation, including tax returns, pay stubs, and bank statements.

Affordable Housing Income GuideAffordable Housing Income Guide

Loading...

Loading...