Table of Contents Show

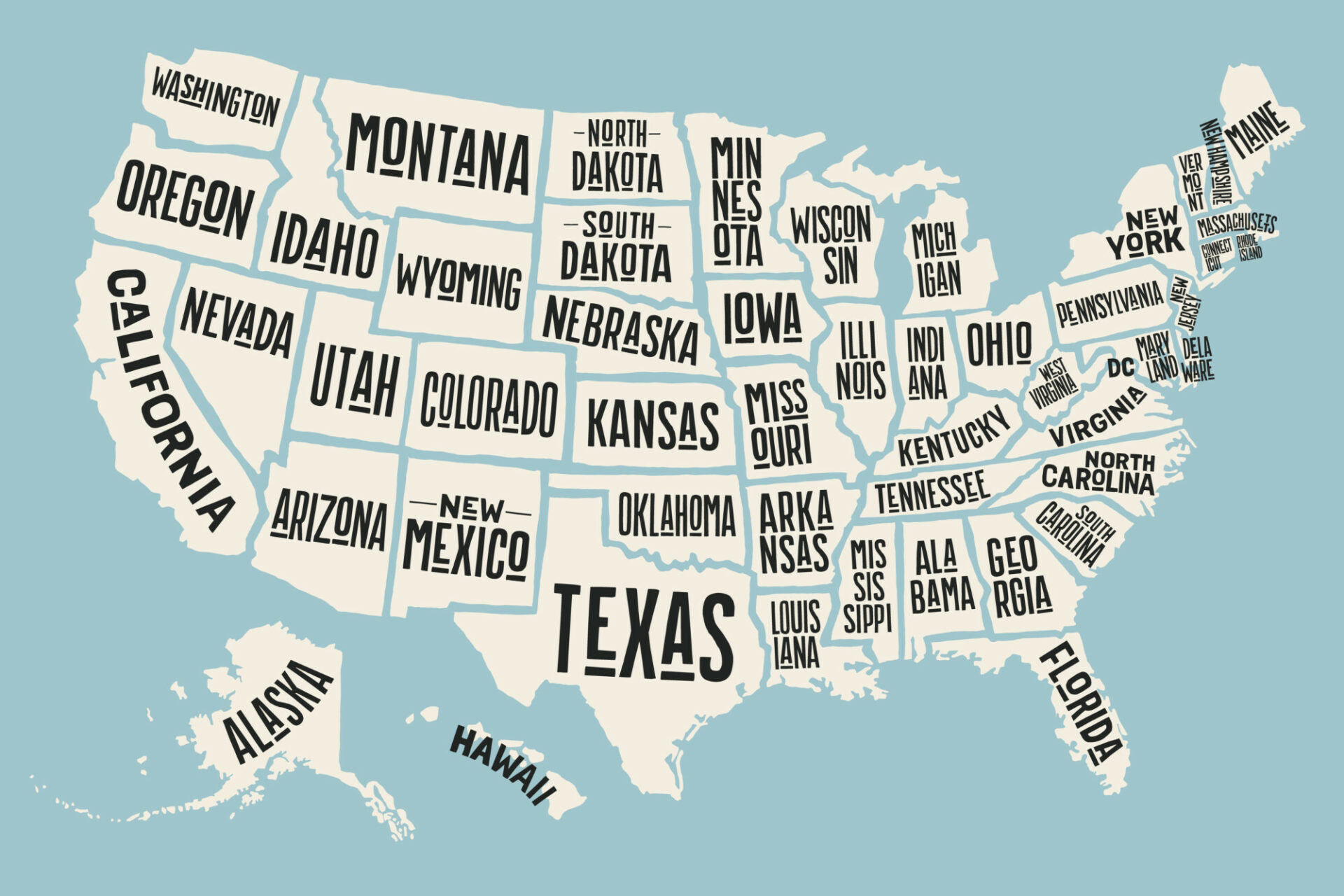

The United States is home to diverse cities with unique characteristics and cost of living. While many cities offer affordable lifestyles, others have gained notoriety for their high expenses. In this in-depth article, we will delve into the U.S.’s most expensive cities, exploring the factors that contribute to their high costs, analyzing key expense categories, including housing and living expenses and the impact of these costs on residents and the local economy, and discussing strategies for coping with the challenges of living in such cities.

Understanding the Metrics: Cost of Living and Housing AffordabilityUnderstanding the Metrics: Cost of Living and Housing Affordability

To assess the expense of living in a city, two crucial metrics come into play: cost of living and housing affordability.

Cost of Living IndexCost of Living Index

The cost of living index measures the relative expense of basic necessities and everyday goods and services in a particular city compared to the national average. It considers various factors such as housing, transportation, groceries, healthcare, and utilities. Higher scores indicate a higher cost of living. Cities with vibrant economies, cultural attractions, and higher living standards typically have a higher cost of living indices.

Housing AffordabilityHousing Affordability

Housing affordability is a crucial aspect when considering a city’s expenses. It assesses the proportion of income required to meet housing costs. A higher percentage of income spent on housing indicates lower affordability. Factors such as housing supply and demand, rental markets, and income levels influence housing affordability in a city.

Average Living ExpensesAverage Living Expenses

| City | Rent (1-bed apartment) | Utilities | Groceries | Transportation |

| New York City | $3,000 | $150 | $400 | $150 |

| Los Angeles | $2,500 | $130 | $350 | $120 |

| Boston | $2,200 | $120 | $300 | $110 |

| Washington D.C. | $2,100 | $110 | $300 | $100 |

| Honolulu | $2,000 | $100 | $350 | $120 |

| San Francisco | $3,500 | $170 | $500 | $180 |

Examining the Most Expensive Cities in the U.S.Examining the Most Expensive Cities in the U.S.

New York City, New YorkNew York City, New York

As the largest city in the U.S., New York City is renowned for its vibrant culture, finance sector, and global influence. The city’s exorbitant housing prices and its elevated cost of living across various categories make it one of the most expensive places to reside. The high demand for housing, limited space, and the allure of the “New York experience” contribute to the city’s costliness.

Annual Average IncomeAnnual Average Income

- Average Income: The average household income in New York City is around $68,000 to $75,000 per year.

Housing PricesHousing Prices

- Average Housing Rental Price: The average rental price for a one-bedroom apartment in New York City varies depending on the neighborhood but generally ranges from $2,800 to $3,500 monthly.

- Average Median Sales Price: The average median sales price for real estate in New York City is approximately $1 million to $1.3 million.

Average Living ExpensesAverage Living Expenses

- Transportation: Monthly expenses for public transit in New York City, including subway and bus fares, can amount to around $127.

- Groceries: The average monthly cost for groceries in New York City can range from $300 to $500, depending on individual preferences and dietary habits.

- Healthcare: Healthcare costs in New York City are typically higher than the national average due to the concentration of medical facilities and services.

- Utilities: Monthly utility bills, including electricity, water, heating, and internet services, can average around $150 to $200.

San Francisco, CaliforniaSan Francisco, California

Known for its booming tech industry and iconic landmarks like the Golden Gate Bridge, San Francisco consistently ranks among the most expensive cities in the U.S. The city’s high housing costs, driven by limited supply and high demand, contribute significantly to its overall expense. The thriving tech industry attracts well-paid professionals, increasing competition for housing and driving up prices.

Annual Average IncomeAnnual Average Income

- Average Income: The average household income in San Francisco is around $100,000 to $120,000 per year.

Housing PricesHousing Prices

- Average Housing Rental Price: The average rental price for a one-bedroom apartment in San Francisco is around $3,500 to $4,000 per month.

- Average Median Sales Price: The average median sales price for real estate in San Francisco is approximately $1.4 million.

Average Living ExpensesAverage Living Expenses

- Transportation: Monthly expenses for transportation in San Francisco, including public transit and occasional ridesharing, can average around $100 to $150.

- Groceries: The average monthly cost for groceries in San Francisco can range from $400 to $600, depending on individual preferences and dietary habits.

- Healthcare: Healthcare costs in San Francisco are generally higher than the national average due to the concentration of medical facilities and services.

- Utilities: Monthly utility bills, including electricity, water, heating, and internet services, can average around $150 to $200.

Los Angeles, CaliforniaLos Angeles, California

Known as the world’s entertainment capital, Los Angeles is another city notorious for its high expenses. The city’s desirable location and booming entertainment and tech industries contribute to its elevated cost of living—housing costs, in particular, significantly burden residents due to limited supply and high demand.

Annual Average IncomeAnnual Average Income

- Average Income: The average household income in Los Angeles is around $59,000 to $65,000 per year.

Housing PricesHousing Prices

- Average Housing Rental Price: The average rental price for a one-bedroom apartment in Los Angeles is around $2,200 to $2,800 per month.

- Average Median Sales Price: The average median sales price for real estate in Los Angeles is approximately $800,000 to $1 million.

Average Living ExpensesAverage Living Expenses

- Transportation: Monthly expenses for transportation in Los Angeles, including gas and insurance for a car, can vary but may average around $150 to $200.

- Groceries: The average monthly cost for groceries in Los Angeles can range from $300 to $500, depending on individual preferences and dietary habits.

- Healthcare: Healthcare costs in Los Angeles are generally higher than the national average due to the concentration of medical facilities and services.

- Utilities: Monthly utility bills, including electricity, water, heating, and internet services, can average around $150 to $200.

Honolulu, HawaiiHonolulu, Hawaii

Located in the stunning island paradise of Hawaii, Honolulu attracts residents and tourists alike with its natural beauty and tropical climate. However, its isolated location, high transportation costs, and scarcity of affordable housing contribute to its position among the most expensive cities. The demand for housing from residents and tourists drives up prices, making it difficult for many to find affordable accommodations.

Annual Average IncomeAnnual Average Income

- Average Income: The average household income in Honolulu is around $80,000 to $90,000 per year.

Housing PricesHousing Prices

- Average Housing Rental Price: The average rental price for a one-bedroom apartment in Honolulu is around $2,000 to $2,500 per month.

- Average Median Sales Price: The average median sales price for real estate in Honolulu is approximately $750,000 to $900,000.

Average Living ExpensesAverage Living Expenses

- Transportation: Monthly expenses for transportation in Honolulu, including gas and insurance for a car or public transportation fares, can vary but may average around $100 to $150.

- Groceries: The average monthly cost for groceries in Honolulu can range from $400 to $600, depending on individual preferences and dietary habits.

- Healthcare: Healthcare costs in Honolulu are generally higher than the national average due to the limited availability of medical services and the higher cost of living on the island.

- Utilities: Monthly utility bills, including electricity, water, heating, and internet services, can average around $150 to $200.

Boston, MassachusettsBoston, Massachusetts

A center for education, healthcare, and research, Boston boasts a rich history and cultural scene. The city’s high housing costs, driven by limited space and strong demand, significantly impact its overall expense. The presence of prestigious universities, hospitals, and research institutions attracts students, professionals, and researchers, putting pressure on the housing market and driving up prices.

Annual IncomeAnnual Income

- Average Income: The average household income in Boston is around $71,000 to $80,000 per year.

Housing PricesHousing Prices

- Average Housing Rental Price: The average rental price for a one-bedroom apartment in Boston ranges from $2,500 to $3,000 per month.

- Average Median Sales Price: The average median sales price for real estate in Boston is approximately $700,000 to $900,000.

Average Living Expenses:Average Living Expenses:

- Transportation: Monthly expenses for transportation in Boston, including public transit and occasional ridesharing, can average around $100 to $150.

- Groceries: The average monthly cost for groceries in Boston can range from $300 to $500, depending on individual preferences and dietary habits.

- Healthcare: Healthcare costs in Boston are generally higher than the national average due to the concentration of medical facilities and services.

- Utilities: Monthly utility bills, including electricity, water, heating, and internet services, can average around $150 to $200.

Washington, D.C.Washington, D.C.

Serving as the nation’s capital, Washington, D.C., is known for its political influence, historical significance, and diverse economy. While the city offers a range of employment opportunities and cultural attractions, its high housing costs and elevated cost of living make it a costly place to call home. The presence of government agencies, non-profit organizations, and lobbying firms creates a competitive housing market, driving up prices.

Annual Average IncomeAnnual Average Income

- Average Income: The average household income in Washington, D.C., is around $85,000 to $95,000 annually.

Housing PricesHousing Prices

- Average Housing Rental Price: The average rental price for a one-bedroom apartment in Washington, D.C., ranges from $2,000 to $2,500 per month.

- Average Median Sales Price: The average median sales price for real estate in Washington, D.C., is approximately $600,000 to $800,000.

Average Living ExpensesAverage Living Expenses

- Transportation: Monthly expenses for transportation in Washington, D.C., including public transit and occasional ridesharing, can average around $100 to $150.

- Groceries: The average monthly cost for groceries in Washington, D.C., can range from $300 to $500, depending on individual preferences and dietary habits.

- Healthcare: Healthcare costs in Washington, D.C., are generally higher than the national average due to the concentration of medical facilities and services.

- Utilities: Monthly utility bills, including electricity, water, heating, and internet services, can average around $150 to $200.

Factors Influencing High CostsFactors Influencing High Costs

Housing Market DynamicsHousing Market Dynamics

Limited housing supply, high demand, and high construction costs contribute to soaring housing prices in these cities. Zoning regulations, land scarcity, and population growth further intensify the issue. The influx of well-paid professionals in industries like technology, finance, and entertainment creates fierce competition for limited housing options.

Urbanization and Job OpportunitiesUrbanization and Job Opportunities

Expensive cities attract residents due to their economic prospects, cultural amenities, and employment opportunities. High-demand job sectors, such as technology, finance, and professional services, concentrate in these urban hubs, leading to increased competition and higher wages. The concentration of industries creates a higher cost of living due to increased demand for goods and services.

Cost of Goods and ServicesCost of Goods and Services

The cost of goods and services, including groceries, healthcare, transportation, and utilities, plays a significant role in the overall expense of living in these cities. Higher demand, transportation costs, local regulations, and taxes impact the prices of everyday necessities. The presence of upscale shopping districts, fine dining establishments, and cultural events also contribute to higher costs.

Impacts on Residents and the Local EconomyImpacts on Residents and the Local Economy

Affordability ChallengesAffordability Challenges

High costs can strain residents’ budgets, particularly those with lower incomes. Rent burden, limited savings, and difficulty in achieving homeownership can hinder financial stability and limit opportunities for growth. This increases inequality and challenges for individuals and families to meet their basic needs.

Talent Retention and AttractionTalent Retention and Attraction

Expensive cities face challenges in attracting and retaining talent. The high cost of living, particularly in housing, may deter individuals and families from considering these cities as long-term residences. The lack of affordable housing options can drive talented individuals to seek opportunities in more affordable cities, affecting the local economy and workforce.

Economic DisparitiesEconomic Disparities

Rising costs can exacerbate income inequality within these cities. While higher wages in specific industries may offset expenses for some, lower-income individuals and families may struggle to afford basic necessities. This disparity can lead to social and economic divisions, impacting residents’ overall well-being and quality of life.

Coping with High CostsCoping with High Costs

Budgeting and Financial PlanningBudgeting and Financial Planning

Residents can navigate high costs by creating realistic budgets, tracking expenses, and prioritizing savings. Setting financial goals, reducing discretionary spending, and seeking cost-effective alternatives can help manage the impact of high costs.

Shared Housing and Co-LivingShared Housing and Co-Living

Sharing housing with roommates or opting for co-living spaces can alleviate the burden of high rental costs. This approach allows individuals to split expenses and share financial responsibility.

Commuting and Alternative TransportationCommuting and Alternative Transportation

In cities with high transportation costs, considering alternative modes of transportation, such as public transit, cycling, or carpooling, can help reduce commuting expenses.

Exploring Affordable NeighborhoodsExploring Affordable Neighborhoods

Researching and identifying more affordable neighborhoods within expensive cities can provide opportunities for lower-cost housing options while still enjoying the benefits of city living.

Final ThoughtsFinal Thoughts

The U.S.’s most expensive cities offer unique opportunities and vibrant lifestyles but come at a premium cost. Housing scarcity, demand, and high living expenses make them costly enclaves. The impacts of these high costs vary, affecting residents’ financial stability and talent attraction and exacerbating income disparities. Understanding the dynamics behind these expensive cities provides insight into the complex relationship between quality of life, economic opportunities, and residents’ financial realities. By implementing strategies for coping with high costs, individuals can navigate these cities and strive for financial stability amidst the challenges they present.