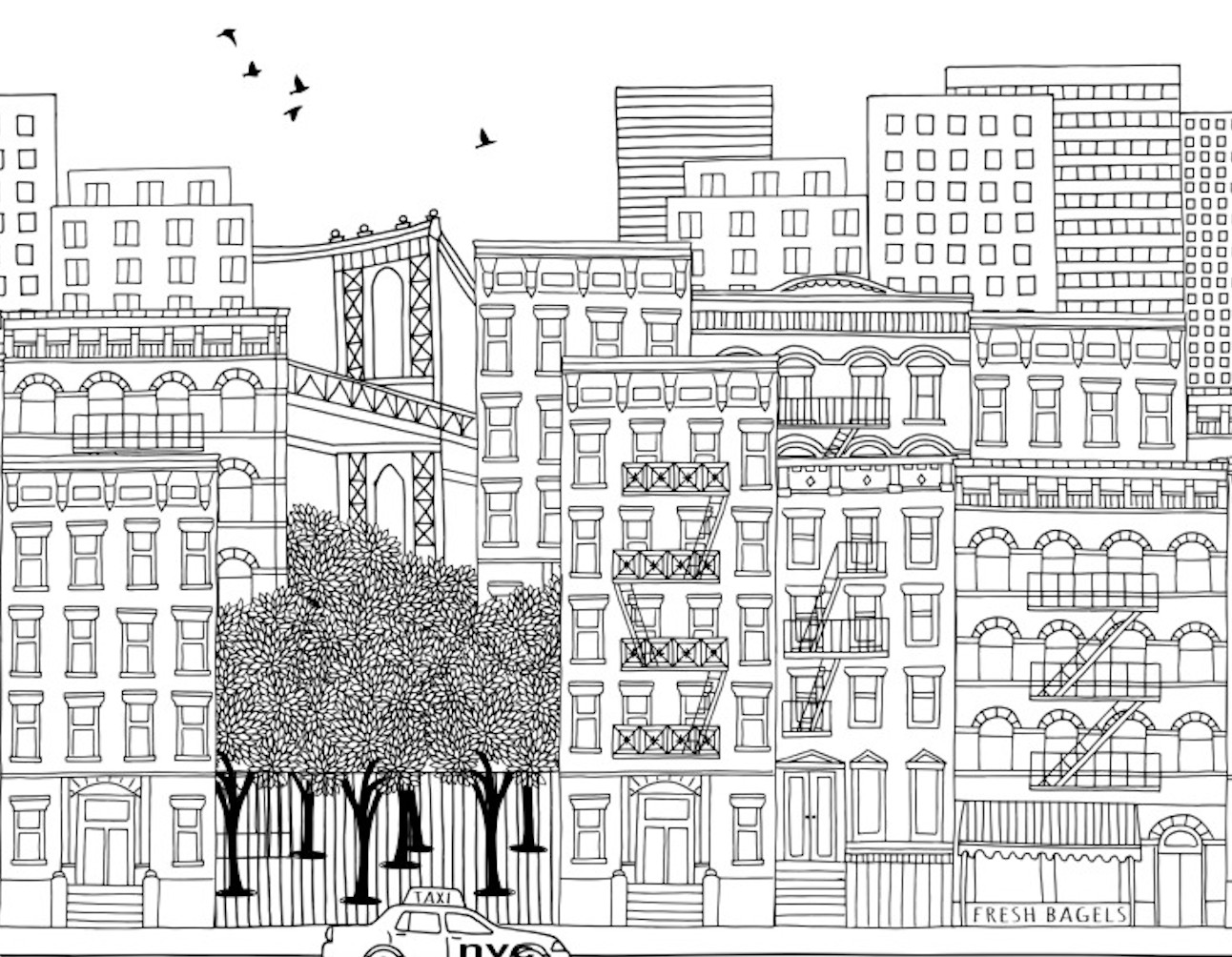

Those who have never purchased a New York City apartment tend to underestimate how long it may take to buy a condo or co-op. Unless you buy a new development or townhouse with all cash, you must cultivate the virtue of patience. However, you can streamline the buying process below with a knowledgeable buyer’s agent, planning, and foresight, from finding a buyer’s agent, attorney, mortgage pre-approval, financing, viewing properties, and the board application to closing day.

NYC Apartments for Sale

Access all New York City apartments for sale with ELIKA New York. Find New developments, condos, and co-op apartments throughout New York City. Search for thousands of apartments in NYC. Discover why ELIKA is New York’s favorite and trusted way to find a home. Whether searching for luxury New York City Apartments, ELIKA offers preferred access to apartments for sale in Manhattan, Brooklyn, and Queens.

ELIKA is a buyer’s agent assisting in purchasing condos and co-op apartments. Contact Us