Table of Contents Show

The journey from dreaming of a new home to unlocking its doors involves a pivotal step: mortgage pre-approval. Amidst the excitement of envisioning a future abode, prospective buyers often overlook this crucial preliminary process. How long does a mortgage pre-approval last, and why is it imperative to secure one before embarking on the quest for the perfect home?

Understanding Mortgage Pre-ApprovalUnderstanding Mortgage Pre-Approval

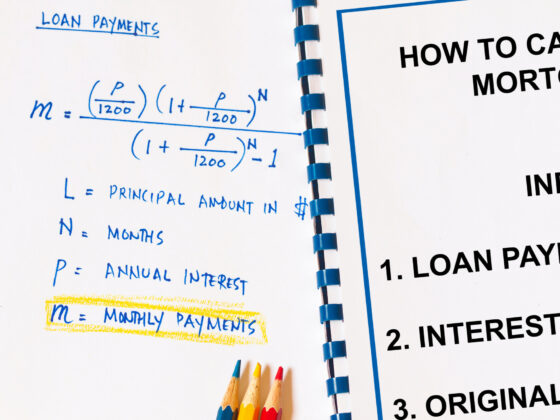

Before delving into its duration, let us dissect the essence of mortgage pre-approval. This preliminary evaluation, conducted by lenders, assesses a borrower’s financial standing, creditworthiness, and ability to secure a loan. Unlike pre-qualification, which offers a mere estimate, pre-approval involves comprehensive scrutiny of financial records, often culminating in a conditional commitment from the lender. This commitment outlines the maximum loan amount the borrower is eligible for, providing a clear roadmap for the homebuying journey.

The Lifespan of Pre-Approval: A Time-Sensitive EndeavorThe Lifespan of Pre-Approval: A Time-Sensitive Endeavor

One of the foremost inquiries among aspiring homeowners revolves around the temporal validity of pre-approval. Typically, pre-approval letters remain valid for 60 to 90 days, though this duration may vary depending on the lender’s policies and market conditions. Beyond this timeframe, lenders may demand updated documentation to ensure the borrower’s financial circumstances remain unchanged.

The Importance of Timing: Navigating the Homebuying OdysseyThe Importance of Timing: Navigating the Homebuying Odyssey

Securing pre-approval before embarking on the house-hunting expedition confers several advantages. Firstly, it empowers buyers with a clear understanding of their purchasing power, delineating the boundaries of affordability and streamlining the search process. Imagine the frustration of finding your dream home only to discover it falls outside your financial reach. Pre-approval eliminates this uncertainty, allowing you to focus on properties that align with your budget.

Moreover, a pre-approved buyer holds a distinct advantage in competitive markets over counterparts who have yet to initiate the pre-approval process. Attaching your pre-approval when submitting an offer is standard practice in New York. Also, with multiple offers, a seller is more likely to take a pre-approved buyer seriously, knowing they are financially qualified and ready to move forward quickly. This can be the deciding factor in securing your dream home.

Mitigating Uncertainty: The Pre-Approval AdvantageMitigating Uncertainty: The Pre-Approval Advantage

A mortgage pre-approval furnishes buyers with financial clarity and instills confidence in sellers. By presenting a pre-approval letter alongside an offer, buyers signal their seriousness and economic credibility, potentially tipping the scales in their favor. Think of it as a handshake that says, “I’m a serious buyer with the resources to back it up.” Furthermore, pre-approval expedites the mortgage application process post-offer acceptance and contract signing, facilitating a smoother transition toward homeownership. With pre-approval, you can move quickly and decisively when the right opportunity arises.

Anticipating Market Fluctuations: The Prudence of Pre-Approval RenewalAnticipating Market Fluctuations: The Prudence of Pre-Approval Renewal

The real estate landscape is fraught with market fluctuations and regulatory changes, so the lifespan of a pre-approval becomes a pertinent consideration. Prudent buyers may periodically renew their pre-approval to preempt any disruptions or discrepancies, ensuring their financial standing aligns with prevailing market conditions. Additionally, substantial changes in employment status, credit score, or debt-to-income ratio necessitate immediate reassessment to uphold the integrity of the pre-approval.

Financial Tips for Aspiring HomeownersFinancial Tips for Aspiring Homeowners

While pre-approval empowers you on your homebuying journey, there’s more to the picture. Here are some additional financial tips to consider:

- Budget for Unexpected Costs: Homeownership comes with unforeseen expenses beyond the mortgage payment. When determining your budget, factor in property taxes, homeowners insurance, and potential maintenance costs.

- Save for a Down Payment: A larger down payment translates to a lower loan amount and potentially a more favorable interest rate. Aim to save diligently for a down payment that strengthens your financial position and reduces your long-term financial burden.

Final ThoughtsFinal Thoughts

In real estate, mortgage pre-approval emerges as a beacon of financial certainty amidst uncertainty. Its temporal validity underscores the importance of strategic timing in the homebuying journey, while its benefits extend far beyond mere convenience. Aspiring homeowners who arm themselves with pre-approval navigate the real estate landscape confidently, poised to transform their homeownership dreams into tangible reality.

Glossary of TermsGlossary of Terms

- Debt-to-Income Ratio (DTI): This metric compares monthly debt payments to gross monthly income. A lower DTI is generally more favorable for obtaining a mortgage.

- Pre-qualification: An initial estimate of how much mortgage you may qualify for based on your self-reported financial picture.

- Pre-approval: A more in-depth analysis of your finances conducted by a lender, resulting in a conditional commitment for a specific loan amount.

By equipping yourself with the knowledge and taking proactive steps, you can embark on your homeownership journey with a clear roadmap and the financial security to achieve your dream.