Table of Contents Show

Vying for a home loan in today’s market can feel overwhelming. Interest rates fluctuate constantly, impacting your monthly payment. A mortgage rate lock can be your anchor in this sea of uncertainty, but when is it the right move for you?

Mortgage Rate Locks: An Anchor in Rough WatersMortgage Rate Locks: An Anchor in Rough Waters

Imagine the excitement of finding your dream home. But then, worries about rising interest rates threaten to capsize your financial plans. Here’s where a mortgage rate lock comes in. It essentially freezes the prevailing interest rate for a specific timeframe, shielding you from fluctuations until you close on the home.

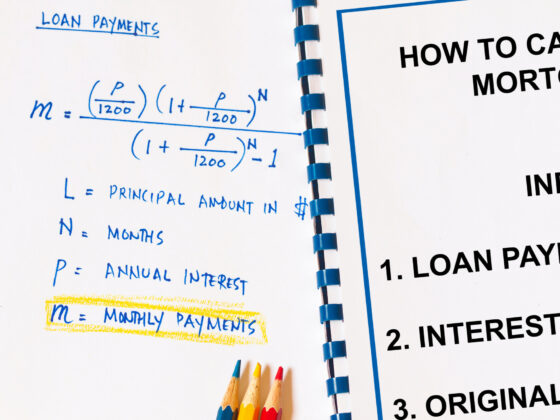

Steering the Course: How Rate Locks WorkSteering the Course: How Rate Locks Work

Think of a rate lock as setting an anchor. Once locked in, your interest rate remains steady, assuming you meet certain conditions and close within the designated timeframe. However, be aware that any significant changes to your loan application, like income or debt, could alter your locked rate.

Riding the Waves: Float-Down Rate LocksRiding the Waves: Float-Down Rate Locks

There’s a flexible option for those wary of being tethered to a fixed rate in a dynamic market – the float-down rate lock. You can snag a lower interest rate if rates drop during your lock period. It’s like adjusting your sails to catch a favorable breeze but with a fee and the onus to seize the opportunity.

Charting Your Course: When to Lock in a RateCharting Your Course: When to Lock in a Rate

The decision to lock your rate depends on several factors, primarily the predicted trajectory of interest rates and your closing date. Are rates expected to rise, making an early lock favorable, or are whispers of a downward trend urging patience?

Setting Sail: Securing a Rate LockSetting Sail: Securing a Rate Lock

So, you’ve decided to lock in your rate. Now what? Much like preparing your vessel for a long voyage, there are vital steps to take. Ensure your credit score is in good shape, gather a sufficient down payment, and complete your mortgage application thoroughly. With your financial ship in order, you can lock in with your current lender or explore other lenders for potentially better rates.

Navigating by the Stars: Mortgage Rate Lock FAQsNavigating by the Stars: Mortgage Rate Lock FAQs

As with any journey, questions arise. When is the optimal time to lock? Can you back out? Why do rates fluctuate? Consider these your guiding stars, providing clarity and direction throughout the process.

Reaching Your HarborReaching Your Harbor

In the vast expanse of the mortgage market, where rates rise and fall like tides, a mortgage rate lock serves as a steadfast companion, guiding you safely to your destination. Whether you choose a fixed rate or navigate with a float-down option, the key lies in understanding your options and planning your course.

Charting Your Course: Lock DurationCharting Your Course: Lock Duration

Understanding the time constraints is crucial as you prepare to set sail on the voyage of mortgage rate locks. Typically, rate locks extend for 30, 45, or 60 days, offering a window of opportunity to navigate the ever-changing mortgage market. Depending on market conditions, some lenders may extend this horizon to 90 or 120 days. However, be wary of delays—extensions often come at a cost, requiring a fee to push back the expiration date.

Extending Your Course: Rate Lock ExtensionsExtending Your Course: Rate Lock Extensions

The comfort of a locked-in rate can be extended, but be prepared to pay a fee. This fee typically ranges from 0.25% to 1% of your loan amount or a flat fee, depending on the lender and the extension duration. So, for a $500,000 loan, a 0.25% extension fee would translate to $1,250. The cost can add up, so it’s wise to communicate effectively with all parties involved to ensure a smooth closing process and avoid the need for extensions whenever possible.

Navigating Uncharted Waters: Expired Rate LocksNavigating Uncharted Waters: Expired Rate Locks

Imagine your rate lock as a guiding light illuminating your path through the complex channels of mortgage financing. But what happens when that light fades with time? Should your rate lock expire before reaching the closing harbor, you may find yourself adrift in uncertain waters.

An expired rate lock introduces challenges. The most significant is the prospect of facing a higher interest rate. Like a ship caught in the doldrums, your financial plans may be subject to the whims of the market. Additionally, you might need to renegotiate terms with your lender or seek alternative financing options altogether.

Calming the Currents: Avoiding Expired LocksCalming the Currents: Avoiding Expired Locks

Here’s how to avoid the complications of an expired rate lock:

- Communicate Effectively: Maintain open communication with your lender, real estate agent, and other parties to ensure a smooth closing process.

- Realistic Timelines: Set realistic timelines for completing all necessary steps before the lock expires. Factor in potential delays like appraisals, title searches, condo and co-op board packages, and co-op interviews, depending on the property you are buying.

- Explore Extension Options: Discuss extending your rate lock with your lender if unforeseen circumstances arise. Be prepared for any associated fees.

Final ThoughtsFinal Thoughts

Equipping yourself with knowledge about mortgage rate locks empowers you to make informed decisions throughout home-buying. Remember, a rate lock can be a valuable tool for navigating the uncertainties of interest rates. By carefully considering your options, timing your lock strategically, and working with a trusted lender, you can chart a course toward your dream home with greater confidence and financial security. Fair winds and following seas!