Table of Contents Show

New York City’s real estate market is as vibrant and diverse as the city. For those looking to purchase property in this iconic metropolis, securing a mortgage is crucial in turning homeownership dreams into reality. Whether you’re a first-time homebuyer or an experienced investor, understanding the landscape of mortgage banks and brokers in NYC is essential. In this comprehensive guide, we will explore the role of mortgage banks and brokers in the city, highlight the benefits of each option, and provide valuable tips for finding the right mortgage for your needs.

The Role of Mortgage Banks and BrokersThe Role of Mortgage Banks and Brokers

Mortgage Banks: Mortgage banks are financial institutions that specialize in originating and funding mortgage loans. Traditional banks, banks hold deposits and offer other banking services. In addition, their focus is on providing mortgage loans to borrowers. Their focus is on providing mortgage loans to borrowers, and they typically have a direct relationship with investors or entities that buy mortgage loans in the secondary market. This allows them to fund conventional and jumbo loans promptly within Fannie Mae and Freddie Mac guidelines.

Mortgage Brokers: Mortgage brokers act as intermediaries between borrowers and multiple lenders. They work with a network of lenders, including banks, credit unions, and wholesale mortgage lenders, to find the best mortgage options for their clients. Brokers assist borrowers in comparing loan offers, submitting applications, and navigating the complexities of the mortgage process. They earn their fees through commissions paid by lenders or borrowers. If you are self-employed or a foreign national, mortgage brokers can be very helpful in matching you with a lender.

Should I Work with a Mortgage Bank or Broker?Should I Work with a Mortgage Bank or Broker?

Deciding between a mortgage bank and a broker is critical when seeking a home loan in New York City. Mortgage banks offer streamlined processes, competitive rates, and reduced fees. However, they might have limited product offerings and less personalized service. On the other hand, mortgage brokers provide access to multiple lenders, negotiation expertise, and valuable guidance, particularly for unique financial situations. While brokers may have potential fees, their services can be invaluable. The choice depends on your preferences, financial situation, and the support you need throughout the mortgage process. Thorough research and understanding your needs will help you decide to achieve your homeownership dreams in a city that never sleeps.

Benefits and Disadvantages of Mortgage Banks and BrokersBenefits and Disadvantages of Mortgage Banks and Brokers

Benefits of Working with Mortgage BanksBenefits of Working with Mortgage Banks

- Direct Access to Mortgage Products: Mortgage banks offer a variety of mortgage products, including conventional loans, FHA loans, VA loans, and jumbo loans. This direct access allows borrowers to explore various options that suit their financial situations.

- Streamlined Process: As both the lender and servicer of the loan, mortgage banks often provide a more efficient and streamlined application process. Borrowers can expect quicker decision-making and efficient communication throughout the loan process.

- Potential Cost Savings: Mortgage banks may offer competitive interest rates and reduced fees compared to traditional banks. Their ability to originate and fund loans in-house can lead to cost savings for borrowers.

Disadvantages of Working with Mortgage BanksDisadvantages of Working with Mortgage Banks

- Limited Product Offering: Mortgage banks are restricted to the mortgage products they offer, which may limit the options available to borrowers. This could disadvantage borrowers seeking specialized mortgage products or unique terms.

- Less Personalized Service: Since mortgage banks are large institutions, their personalized service may not match that of smaller lenders or brokers. Some borrowers may prefer more individualized attention during the mortgage process.

Advantages of Utilizing Mortgage BrokersAdvantages of Utilizing Mortgage Brokers

- Access to Multiple Lenders: One of the most significant advantages of working with a mortgage broker is gaining access to a network of lenders. Brokers can present borrowers with various loan options from different institutions, enabling borrowers to compare rates and terms to find the best fit.

- Negotiation on Behalf of Borrowers: Mortgage brokers advocate for borrowers, negotiating with lenders to secure favorable terms. This expertise can significantly benefit borrowers with unique financial situations or credit histories.

- Expert Guidance: Navigating the mortgage process can be complex, especially for first-time homebuyers. Mortgage brokers offer valuable expertise and guidance throughout the process, simplifying paperwork and ensuring a smooth transaction.

Disadvantages of Utilizing Mortgage BrokersDisadvantages of Utilizing Mortgage Brokers

- Potential Fees: Mortgage brokers earn their income through commissions from lenders or borrowers. While brokers’ services are typically complimentary for borrowers, some lenders may pass on the broker’s fee to the borrower in the form of higher interest rates or closing costs.

- Broker Variability: The quality and expertise of mortgage brokers can vary significantly. Some brokers may not have access to a broad network of lenders or may lack the experience to navigate complex mortgage scenarios.

Here is a table that summarizes the pros and cons of working with a mortgage broker vs. a bank:Here is a table that summarizes the pros and cons of working with a mortgage broker vs. a bank:

| Mortgage Broker | Bank |

| Access to a wider range of lenders | Limited to the loans they offer themselves |

| More personalized service | Less responsive and attentive to borrowers’ needs |

| Less paperwork and hassle | More paperwork and hassle |

| More flexibility | More restrictive lending criteria |

| May charge a fee | No fee |

| It can be more time-consuming | Quicker process |

Tips for Choosing a Mortgage Bank or Broker in NYCTips for Choosing a Mortgage Bank or Broker in NYC

- Ask Your Buyer’s Agent: If you are working with a real estate buyer’s agent, don’t hesitate to seek their advice and recommendations regarding mortgage banks and brokers. Experienced buyer agents often have valuable insights into the local market and can guide you to reputable mortgage professionals they have worked with successfully.

- Research and Compare: Take the time to research mortgage banks and brokers in NYC. Look for institutions or individuals with a strong track record of customer satisfaction and a good reputation in the industry.

- Check Licensing and Credentials: Ensure the mortgage broker or bank is licensed to operate in New York. Additionally, check for professional certifications or accreditations demonstrating their expertise in the mortgage industry.

- Read Reviews and Testimonials: Read online reviews and testimonials from previous clients to gauge the level of service and satisfaction the mortgage bank or broker provides.

- Evaluate Rates and Fees: Compare interest rates, loan terms, and associated fees offered by different mortgage banks or lenders presented by brokers. Consider the total cost of the loan over its lifetime, including points, closing costs, and other expenses.

- Ask Questions: Don’t hesitate to ask questions about the loan process, required documentation, and any potential challenges specific to your financial situation. A reputable mortgage bank or broker will be transparent and informative.

Mortgage Rates TodayMortgage Rates Today

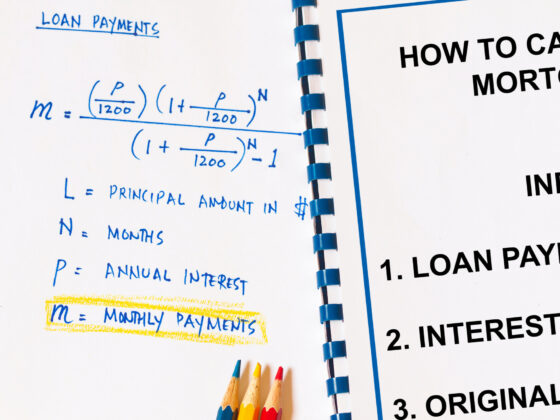

Need an NYC Mortgage Calculator?Need an NYC Mortgage Calculator?

Look no further! Our NYC mortgage calculator is a valuable tool that can help you assess your ability to secure a mortgage. Estimate your monthly payment by factoring in crucial elements such as principal and interest, property taxes, common charges or maintenance fees, and homeowner’s insurance. Take advantage of our powerful resources to make informed decisions about your affordability and pave the way toward fulfilling your dream of owning a home in New York.

New York-Based Mortgage Banks and Top-Rated Mortgage BrokersNew York-Based Mortgage Banks and Top-Rated Mortgage Brokers

As a hub of real estate activity, New York City is home to several prominent mortgage banks and top-rated mortgage brokers. Here are some noteworthy institutions:

New York-Based Mortgage Banks:New York-Based Mortgage Banks:

Chase: Chase, a part of JPMorgan Chase & Co., is one of the largest and most well-known banks in the United States. They offer various mortgage products, including fixed-rate and adjustable-rate mortgages, to cater to multiple borrower needs. Chase is recognized for its competitive interest rates and efficient mortgage application process.

- Website: www.chase.com/mortgage

- Phone: 1-800-873-6577

- Address: 270 Park Avenue, New York, NY 10017

Wells Fargo: Wells Fargo is another major financial institution with a strong presence in New York City. They provide various mortgage options and are known for their commitment to customer service. Wells Fargo offers online tools and resources to assist borrowers in navigating the mortgage process.

- Website: www.wellsfargo.com/mortgage

- Phone: 1-800-869-3557

- Address: 150 East 42nd Street, New York, NY 10017

Citibank: Citibank, a subsidiary of Citigroup, is a global bank with a significant presence in New York City. They offer competitive mortgage rates and diverse mortgage products, making them an attractive option for homebuyers seeking financing in the city.

- Website: www.citibank.com/mortgage

- Phone: 1-800-248-4638

- Address: 388 Greenwich Street, New York, NY 10013

HSBC Bank: HSBC is an international bank with a significant presence in New York City. They offer various mortgage products catering to a diverse clientele, including international homebuyers.

- Website: www.us.hsbc.com/mortgage

- Phone: 1-800-975-4722

- Address: 452 Fifth Avenue, New York, NY 10018

New York Mellon Bank: BNY Mellon, also known as The Bank of New York Mellon, is a prominent financial services company that provides mortgage services in the NYC market. They offer a range of mortgage solutions and pride themselves on their commitment to personalized attention.

- Website: www.bnymellon.com/mortgage

- Phone: 1-866-205-9122

- Address: 225 Liberty Street, New York, NY 10281

Top-Rated Mortgage Brokers:Top-Rated Mortgage Brokers:

Mortgage Master: Mortgage Master is a well-regarded mortgage broker known for its personalized service and expert guidance. They work closely with borrowers to understand their needs and connect them with the best mortgage options.

- Website: www.mortgagemaster.com

- Phone: 1-800-724-7765

- Address: 245 Park Avenue, New York, NY 10167

Guaranteed Rate Mortgage: Guaranteed Rate Mortgage is a well-established mortgage broker with a strong presence nationwide, including in New York City. They provide a user-friendly online platform that streamlines the mortgage application process and offers competitive mortgage rates to borrowers.

- Website: www.guaranteedrate.com

- Phone: 1-866-934-7283

- Address: 655 Third Avenue, New York, NY 10017

GuardHill Financial Corp: GuardHill Financial Corp is a highly regarded mortgage broker with a strong presence in the NYC market. They specialize in providing tailored mortgage solutions and offer personalized assistance to help borrowers find the right loan for their unique circumstances.

- Website: www.guardhill.com

- Phone: 1-800-853-7074

- Address: 140 East 45th Street, New York, NY 10017

Best Solution Mortgage, Inc: Best Solution Mortgage is a trusted mortgage broker known for its commitment to finding the best mortgage solutions for its clients. They have a team of experienced professionals who guide borrowers through the mortgage process from start to finish.

- Website: www.bestsolutionmortgage.com

- Phone: 1-877-999-7878

- Address: 1345 Avenue of the Americas, New York, NY 10105

Final ThoughtsFinal Thoughts

Securing a mortgage in New York City can be a transformative step towards homeownership or real estate investment. Understanding mortgage banks’ and brokers’ roles and advantages can help borrowers make informed decisions aligning with their financial goals. Whether you work directly with a mortgage bank for direct access to mortgage products or utilize the services of a mortgage broker to access a broader range of lenders, the key to a successful mortgage journey lies in thorough research, comparison, and thoughtful consideration. By partnering with the right mortgage professional, you can navigate the intricacies of the NYC real estate market and embark on a rewarding path to homeownership in the city that never sleeps.