Most people’s initial reaction is to eliminate their mortgage debt. Living in your home free and clear can give you an incredible sense of accomplishment. However, before throwing yourself a mortgage-burning party, there are other considerations. After all, the bank will not be able to repossess your home, and the entire value will count towards your net worth. Financially, it may not be prudent to prepay the principal on your mortgage under current conditions.

What is prepaying?What is prepaying?

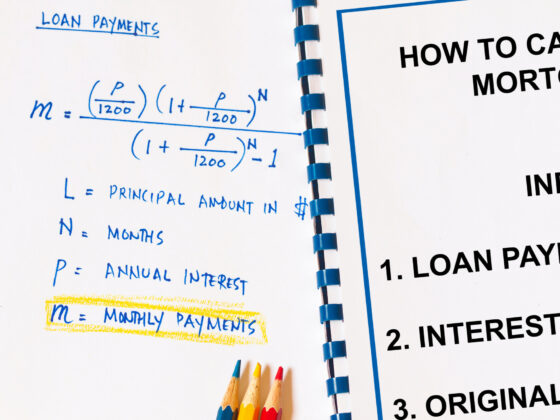

When you take out a mortgage, you agree to pay back the money. The most common loan terms are a fixed rate over 30 years.

You earnestly pay your mortgage each month, and your balance does not decline much. However, very little principal is paid in the early years. For instance, on a $500,000, 30-year mortgage at an interest rate of 4.5%, the mortgage payment (principal and interest) would be $2,533.43. In the first month, the principal sum would be $658.43, and the interest would be $1,875. It does not get much better the next month when the principal amount is $660.90. For the first 15 years, less than $126,000 in principal is paid, and over $287,000 in interest.

Over the life of the loan, over $412,000 will be paid in interest.

If this does not seem fair, the banks are the ones that lend you the money and get to make the rules. The first one is that the lending institution gets paid first.

There is something you can do about it, though. Pay extra money towards the principal. This is known as prepaying. It is merely done by noting the additional amount with your physical check or online. It is essential to do so. Otherwise, it may wind up in a “suspense account” or unapplied until you notify the lender.

Applying an extra $100 to your monthly mortgage payment cuts off more than two years from your mortgage. It also saves roughly $37,000 in interest over the life of the loan.

Use our mortgage calculator – this will allow you to do your calculations.

Sounds great; what’s the catch?Sounds great; what’s the catch?

As we have seen, this can allow you to save thousands of dollars in interest over the life of your loan and cut down the length of your mortgage. Nonetheless, taking the emotions out of the decision, a crucial financial consideration must be weighed before deciding whether to make extra principal payments.

In finance, there is a concept known as the opportunity cost. Simply put, this is the cost of not choosing an alternative path. For instance, instead of putting your money under my mattress, one could invest in a bond at a 5-year bond at a top-rated company and earn 1.8% annually over five years.

Stripping out the emotional benefits, we need to consider if it is worthwhile financially to prepay your mortgage or invest it. The same principle applies here. We compare the mortgage rate to the return rate achieved by an investment opportunity.

To make the proper comparison, we need to factor in taxes. Since mortgage interest is tax-deductible, your mortgage rate is lower than stated. For instance, if you have a 4.5% mortgage rate and your marginal federal income tax bracket (i.e., since we have a graduated income tax, the rate you pay on your last dollar of earnings) is 25%, your effective rate is 3.375%. This is merely 4.5% multiplied by 75% (1-tax rate). It will be even lower in New York since there is a state income tax, and your mortgage interest is also likely to be tax-deductible on your state return.

We need to compare the 3.375% rate of return you can earn. However, this is not a very high threshold. If you can get a modest return of 5%, your after-tax return is 3.75% (5% multiplied by 75%, although dividends and capital gains may have lower tax rates, or it will grow tax-deferred retirement accounts such as a 401k or IRA). Since your investment return is higher, investing the money is worthwhile rather than prepaying your mortgage.

ConclusionConclusion

Since mortgage rates are low, you should think twice about prepaying your mortgage. Instead, it might be wiser to invest the money. For instance, if you are not taking advantage of your company’s 401k match, that is a viable option.