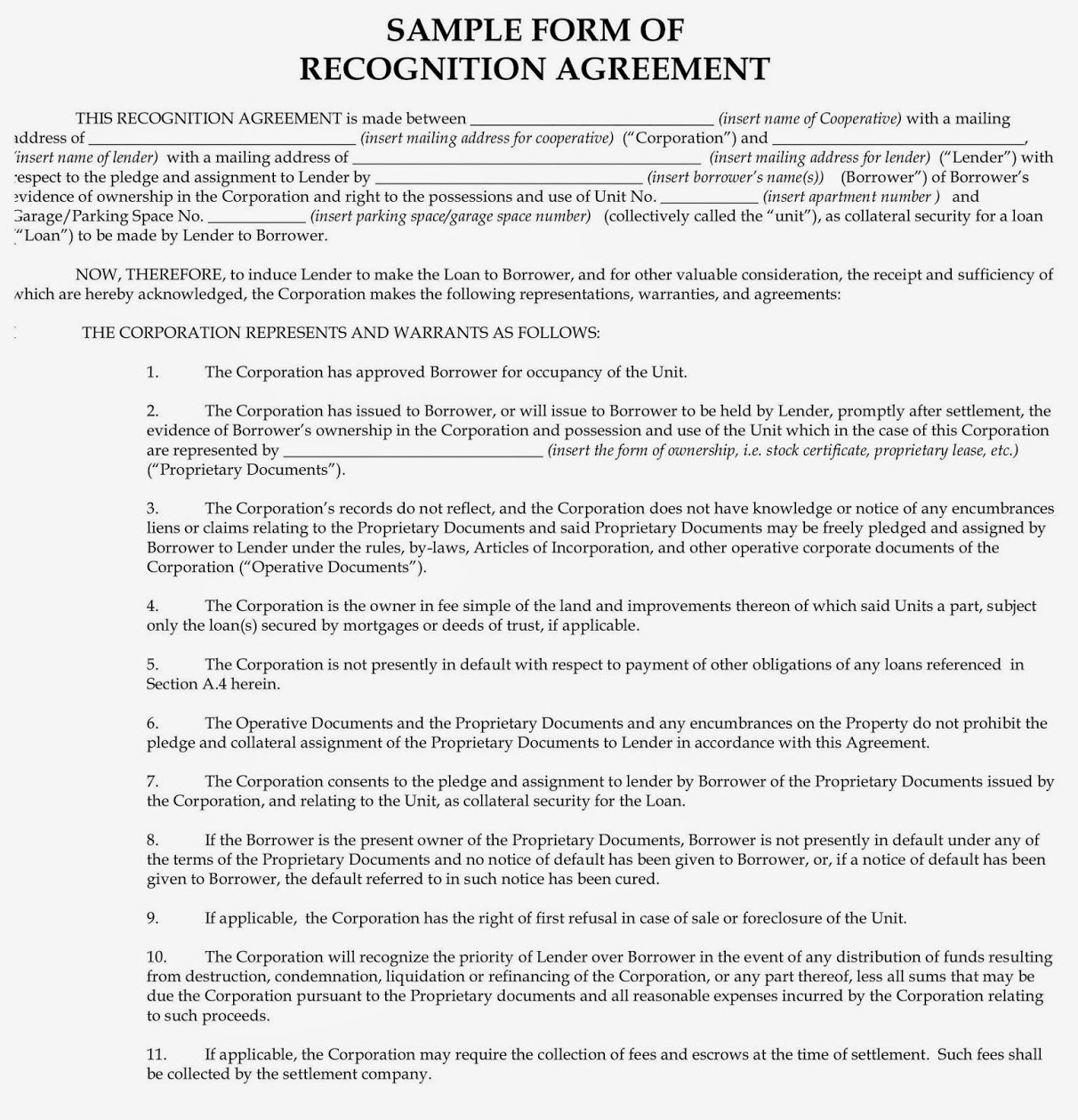

Anyone who has purchased a co-op apartment in New York City will be familiar with the Aztech Recognition Agreement. However, if you’re wondering what an ancient Mexican civilization has to do with purchasing a co-op apartment, don’t worry. It tends to confuse and not just because of the name.

Here we break it down for you, explaining what it is and how it works. As you’ll see, it has nothing to do with Mexican history and everything to do with board packages of buyers financing a co-op purchase.

What is an Aztech Recognition Agreement?What is an Aztech Recognition Agreement?

The Aztech Recognition Agreement (sometimes spelled Aztec) is a three-party contract between the buyer, lender, and co-op. It gets its name from the company that produces it, the Aztech Document Systems company, which dates from a not-so-old date of 1973 A.D. previously, lenders would negotiate directly with developers and co-op converters to create custom documents for individual shareholders.

Anyone who wishes to purchase a co-op apartment does so by buying shares in the corporation. The sales contract includes the agreement protecting both the lender and the co-op. The document stipulates that the co-ops lien gets priority over the banks. If the buyer defaults on their payments, there will be no changes to the lease without the bank being notified first. You will need one of these documents if you do so through mortgage financing.

The lender agrees to make payments on behalf of the defaulted shareholder. The co-op also promises to notify the lender if the buyer fails to pay maintenance or other co-op fees through the agreement. In addition, procedures for the lender and co-op, including Instructions in case of a default event. They are thus preventing the co-op from foreclosing. This way, it works as an early warning system of a borrower’s financial difficulty with the lender.

What are the benefits?What are the benefits?

The main benefit of an Aztech agreement is that it allows buyers to purchase a co-ops apartment with financing that will improve property values to the benefit of all shareholders. As a bonus, it permits the lender to monitor the shareholder’s timeliness of maintenance payments. Thus, it effectively makes the lender a guarantor of a shareholder’s maintenance fees.

Shareholders tend to be more concerned about potentially going into arrears than making timely maintenance payments. It usually takes one letter from the lender to ensure they keep their payments on time.

How can I get the Aztech Recognition Agreement?How can I get the Aztech Recognition Agreement?

The banks issue the Aztech agreements. These must be mutually agreed upon between the three parties before a loan can close. Once released and accepted, you will include it in the board package. The whole point of the agreement is to protect the co-op in the event of a default. In return, the security interest of the lender is protected. However, some co-ops require the use of their recognition agreement and will not accept the lender’s version.