Table of Contents Show

Discussions about rising interest rates and the corresponding impact on mortgage borrowing rates are a popular news topic. The average rate continued to grow; with fixed 30-year mortgage rates increasing to 4.38% last week from 4.32% and 4.22% the prior two weeks, according to Freddie Mac (all mortgages rates referenced are based on this agency’s information), steadily increasing, up from under 4% at the end of last year.

Everything else being equal, higher borrowing costs mean a larger monthly payment. However, you can perhaps use the negotiation situation to strike a better price rather than making up for the higher interest rate while reaping a larger potential capital gain. Since this is a complicated area, it is helpful to break down how New York City real estate has done various interest rate environments.

Effects of Rising Interest Rates on Home PricesEffects of Rising Interest Rates on Home Prices

The ‘70sThe ‘70s

Tough time for the country and the city. NYC nearly went bankrupt. Macroeconomic issues affecting the country and the city included the OPEC embargo, with gas prices doubling twice in the decade.

In 1973, inflation jumped from under 4% to nearly 10%, and the Federal Reserve raised short-term rates to get it under control. Along with other factors, this helped drive double-digit, “run-away” inflation. Similarly, the Fed raised rates to about 20% in 1979-1980 to break inflation’s back.

The ten-year Treasury rate started the decade under 10% and finished near 11%. Again, highlights a particularly tricky period; at the start of 1974, the yield was 6.99%, and ended 1979 at 10.8%. Meanwhile, the 30-year mortgage rate went from 7.3% in April 1971 (the furthest back Freddie Mac’s data goes) to nearly 13% by 1979.

The NYU Furman Center, which studies public policy and real estate, noted prices fell 12.4% from 1974 through 1980. While the other boroughs experienced price declines, Manhattan’s real estate saw a 29% increase.

The ‘80sThe ‘80s

The decade started with negative sentiment about the economy, with Federal Reserve Chairman Paul Volker driving up short-term rates. As a result, the 10-year yield peaked at nearly 15% in 1982, and the 30-year mortgage fixed rate reached 18.6% in 1981. After that, the mortgage rate bounced around slightly but ended the decade in the upper-9%-10% area.

Helping; to lead to a robust real estate market. After the early-1980s recession, the economy performed well. With inflation taming and lower borrowing costs, real estate prices, which had tempered the previous decade, thrived. New York City experienced a 152% price increase, with Manhattan, Brooklyn (particularly areas close to Manhattan), and Queens doing better than the average.

The ‘90sThe ‘90s

The decade started in a recession, partly triggered by the S&L crisis. As a result, lending standards tightened, and credit became more difficult to obtain. However, the Clinton presidency brought on more aggressive deficit reductions, and long-term interest rates fell. The bond market was doing well, and stock and real estate prices soared.

Ten-year Treasury yields started at 8.2% and began in 1999 at 4.7%, although they rose to 6.7% at the end of the year. Mortgage rates were 9.8% and finished the 1990s at 8.1%. Before the decade’s end, interest rates hovered at the 7% level and even dipped below it.

Ten-year Treasury yields started at 8.2% and began in 1999 at 4.7%, although they rose to 6.7% at the end of the year. Mortgage rates were 9.8% and finished the 1990s at 8.1%. Before the decade’s end, interest rates hovered at the 7% level and even dipped below it.

New York City’s real estate prices fell in the first half of the decade. In the 1989-1996 period, prices were down 29%, with Manhattan, the Bronx, and Staten Island performing worse. It came about despite generally falling interest rates. The 30-year mortgage rose from 9.8% to over 10% during 1990, before dropping through 1994. The mortgage rate was under 8% by the end of 1996.

From the mid-‘90s to 2006From the mid-‘90s to 2006

During this time, which included the tech bubble bursting and the 9-11 terrorist attack, mortgage rates fell dramatically. It was below 6% at one point. The recession was brief, and New York City’s real estate prices rose 124%. Manhattan and Brooklyn were notable hot spots.

2007-Current2007-Current

For this period, Furman doesn’t have pricing data, which started with the severe recession and housing crash. Mortgage rates were above 6% for most of 2007 but have generally been below 5%, and even lower than 4% for the latter parts of the current era. New York City’s real estate, responding to the severe economic conditions, fell sharply before spending the last several years in recovery as the economy rebounded.

Final thoughtsFinal thoughts

Interest rates are one factor among several that impact the real estate market. However, it appears the overall economy is the most important. For example, while mortgage rates fell during the last recession, real estate prices did not recover until economic conditions, particularly the jobs market, improved, making people more confident about making a large-scale purchase.

Long-term bond yields have risen for a multitude of reasons. These include recent economic data indicating a pick-up in inflation, such as the latest jobs report showing a tighter market and higher wages. Additionally, the recently passed tax cut legislation will drive budget deficits higher, and the Federal Reserve is tapering its bond-buying program. As a result, the ten-year Treasury yield, which correlates to the popular 30-year fixed-rate mortgage, has been hovering around 2.8% recently, compared to last year’s 2.2%-2.5% level.

In response, the 30-year fixed-rate mortgage has seen the rate climb to 4.22%, on average, according to Freddie Mac. Again, I am comparing it to under 4% for most last year.

This situation creates stress for buyers, naturally. Higher borrowing rates mean a larger monthly payment, all else equal. However, you need not fret. You can use this situation to your advantage, and you do not have to get stuck paying more every month.

The greatest sensitivityThe greatest sensitivity

We have found the $3 million and under market the most active part of New York City’s real estate market. It is also the most sensitive to interest rate changes for various factors. Those shopping at the lower end are more sensitive to higher payments. Personal income may be up, but spending has risen faster. This means fewer savings, potentially pricing these homebuyers out of the market.

Luxury property buyers likely have alternative sources to fund the purchase, including more significant cash reserves. The market has already been experiencing weakness, in any case.

It seems like a frustrating situation, but it is not as bleak as it appears.

Hope for the home buyerHope for the home buyer

House hunters should not lose faith. If they are ready to purchase and see a deal, buyers should act quickly. Sellers may not have caught up to the story since demand may not have softened yet. They are typically slow to accept a slowing market. Therefore, if you are comfortable and your buyer’s agent feels this is a fair price, do not be afraid to act. Interest rates could go up further, raising your monthly payment.

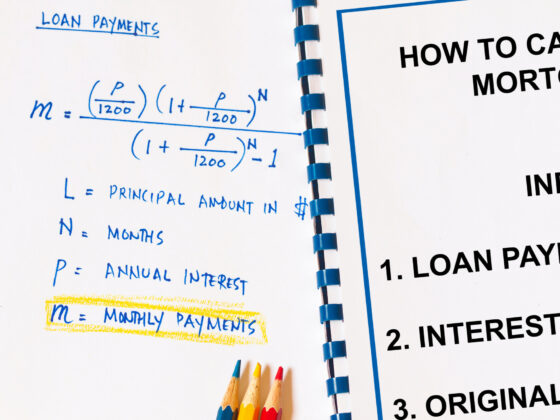

Assuming an $800,000 purchase and a 20% down payment, your monthly payment is $3.137 (principal and interest). Just a quarter-point rate increase causes your outlay to rise to $3,231, nearly an extra $100 you would have to fork over per month.

Another strategy is to wait, hoping this gives you more bargaining power. Risky, predicated on higher rates and further softening demand, however.

Final thoughtsFinal thoughts

U.S. Treasury yields retreated a few basis points this week. Due to the stock market’s pullback. Investors took a “risk-off” approach, piling into risk-free Treasuries rather than riskier assets, such as equities. In February’s wake of the equity market’s pullback, the 10-year yield fell back to 2.77% from 2.84%.

While predicting future interest rate moves is challenging, homebuyers should not count on this trend continuing. Ultimately, market fundamentals will drive interest rates with a particular eye on inflation.