Table of Contents Show

The Great Recession experienced last decade seems like a distant and unpleasant memory. As New York City home prices have rebounded, it might be tempting to forget that unpleasant time. It would help if you refrained from doing so, however. There are valuable lessons to be gained. The saying goes, “Those who fail to learn from history are doomed to repeat it.” With that in mind, we remind readers, so they do not get fooled again.

Don’t let your emotions carry you.Don’t let your emotions carry you.

Many people get emotional when buying (or selling) an apartment. After all, it is more than walls and floors. It is at home. Many buyers wound up bidding wars in the years leading up to the bubble bursting, paying far more than the fair market value.

There were several psychological reasons they did this. Buyers were afraid of losing out on a property, fearing the price of the next apartment would be higher. People did not want to lose; viewing it is a game. Lastly, some were emotionally connected to the property, getting that “homey” feeling.

Remember, there is more than one apartment for you. New listings crop up all the time. The best way to avoid overpaying is to have a budget beforehand and understand the current fair market value.

Financing mattersFinancing matters

Looking beyond your monthly payment and truly understanding the loan terms is essential. Many were suckered by a low initial monthly mortgage payment, only to discover the payment ballooned after the teaser rate expired for these adjustable-rate mortgages. Lenders advised people not to worry since housing prices always go up and refinance the principal balance. Other questionable financings were interest-only mortgages. There were also questionable documentation practices, with loans made with little or no income and asset verification.

What can you do? Understand your mortgage options. The Consumer Financial Protection Bureau (CFPB) was created in the aftermath. They put certain protections in place to make it easier for you. There is a Know Before You Owe mortgage disclosure rule. Two forms are easier to understand than the four disclosure forms these replaced. This is the Loan Estimate form, making it easy to compare loans from different lenders, and the Closing Disclosure. You are required to have three business days to review your Closing Disclosure.

Patience pays offPatience pays off

Many people that bought apartments in the years leading up to the recession saw large paper losses in the ensuing years. Granted, it is not easy to continue paying a mortgage on an apartment that has declined to the point where you have negative equity (mortgage balance is more than the apartment’s value). But, remember, it is not a loss until you sell. Provided you have the right financing and have done the proper budgeting to afford your place, the best thing might be to ride out the economic malaise. To pass muster with the co-op board, you had to show adequate reserves and assets, meaning you should be able to ride out the storm.

Generally, real estate is not a get-rich scheme. Historically, over the long term, it has risen at the pace of inflation. That is what you should expect, although it may be a bumpy ride in the short term.

Use an exclusive buyer’s agent.Use an exclusive buyer’s agent.

Many buyers thought their agent was on their side. However, there might have been a dual agency in this case. A buyer and seller had separate agents, but both worked for the same company. It was in their economic interests to obtain the highest price and earn the highest commission. Even in cases where your agent did not work for the same real estate broker, they still wanted the highest price to earn a larger commission.

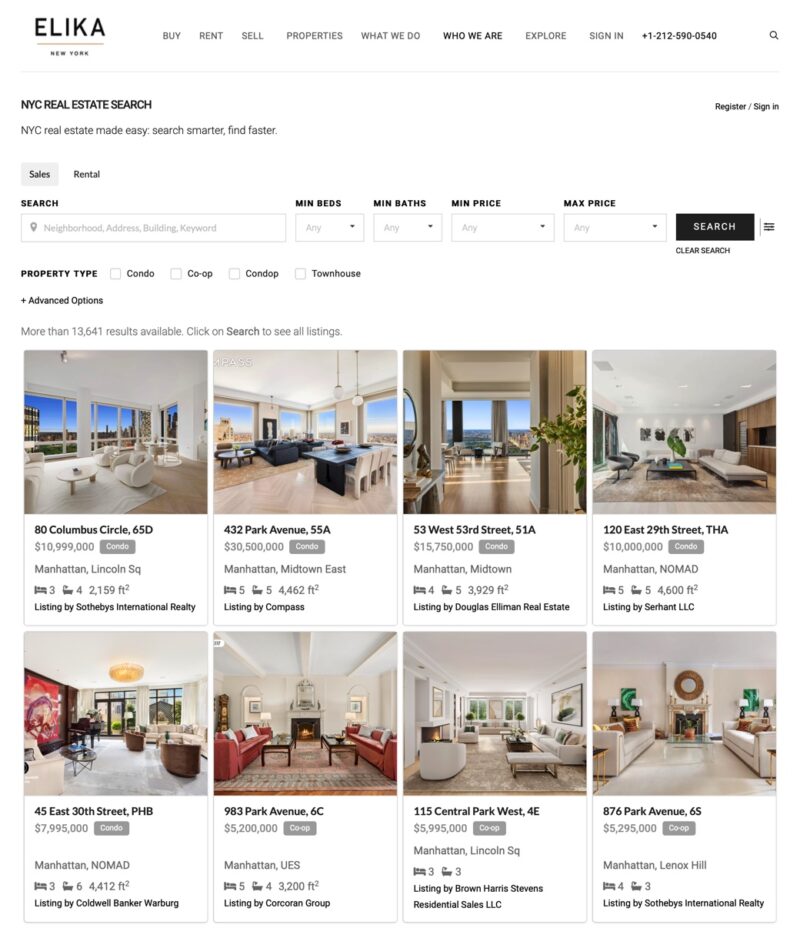

There is another way. An exclusive buyer’s agent owes their fiduciary duty to you, the buyer. This means the agent is legally obligated to help you obtain the best price, use information helpful to you (e.g., pending divorce situation), and conduct a thorough market analysis.

Final thoughtsFinal thoughts

We hope never to experience such a severe recession again in our lifetime. However, the economy has been expanding for several years, and a recession sometime in the future is inevitable. Hopefully, these tips guide for you to avoid making a costly mistake.