NYC REAL ESTATE BLOG NYC REAL ESTATE BLOG

Real Estate Calculators by ELIKA New York

ARCHIVESARCHIVES

Understanding Buyer’s Vs. Seller’s Markets in Real EstateUnderstanding Buyer’s Vs. Seller’s Markets in Real Estate

Imagine you’re about to buy your dream home. Will you face bidding wars and fierce competition, or will you have a more comprehensive selection and room for negotiation? The answer…

Share

How Long Does a Mortgage Pre-Approval LastHow Long Does a Mortgage Pre-Approval Last

The journey from dreaming of a new home to unlocking its doors involves a pivotal step: mortgage pre-approval. Amidst the excitement of envisioning a future abode, prospective buyers often…

Share

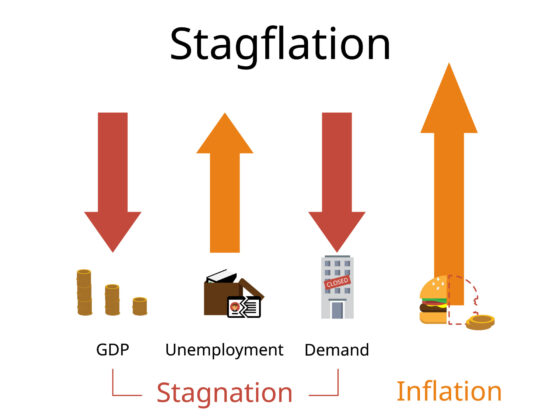

Stagflation Looms: A Perfect Storm Brewing in the Housing Market?Stagflation Looms: A Perfect Storm Brewing in the Housing Market?

The recent economic data release sent shockwaves through financial markets, igniting concerns of a dreaded economic phenomenon: stagflation. Gross Domestic Product (GDP) growth for the first…

Share

Claire AI vs. Conventional Human Agents: Buying in the Age of AIClaire AI vs. Conventional Human Agents: Buying in the Age of AI

Innovation is the game’s name in the fast-paced world of real estate. With the introduction of Claire by reAlpha Tech Corp., the real estate industry is witnessing a groundbreaking shift…

Share

JUST IN: President Biden Proposes Changes to Capital Gains TaxJUST IN: President Biden Proposes Changes to Capital Gains Tax

President Biden has unveiled a proposal to significantly increase capital gains tax rates, potentially reshaping the landscape of investment and real estate markets. If approved, the plan…

Share

Mortgage Rate Locks: Anchoring Your DreamsMortgage Rate Locks: Anchoring Your Dreams

Vying for a home loan in today’s market can feel overwhelming. Interest rates fluctuate constantly, impacting your monthly payment. A mortgage rate lock can be your anchor in this sea of…

Share

DIY Approach: Why Real Estate Agents Remain EssentialDIY Approach: Why Real Estate Agents Remain Essential

The siren song of the self-made life extends far beyond artisanal sourdough. In the age of online marketplaces and readily available information, the real estate industry has witnessed a rise…

Share

Home Hunting Must-Haves Checklist in NYCHome Hunting Must-Haves Checklist in NYC

New York City is a vibrant tapestry of cultures, iconic landmarks, and an ever-evolving landscape. Yet, for many, the dream of calling this metropolis home can quickly morph into a daunting…

Share

Rising Tides: NYC’s Measures to Protect Waterfront CommunitiesRising Tides: NYC’s Measures to Protect Waterfront Communities

Living by the water in New York City offers a unique charm. The salty breeze, the sparkling harbor views, and the constant hum of serene activity create a coveted lifestyle. But for many New…

Share

The Redefined Landscape: Real Estate Predictions for 2024-2028The Redefined Landscape: Real Estate Predictions for 2024-2028

The real estate market, long characterized as a perpetual engine of change, has undergone profound transformations catalyzed by the seismic events of the COVID-19 pandemic. While the echoes of…

Share

Locked In: Low Rates Discourage Homeowners From SellingLocked In: Low Rates Discourage Homeowners From Selling

The housing market, a once-frenzied engine of economic activity, has entered a peculiar phase. Homeowners, facing a stark contrast between their current ultra-low mortgage rates and the…

Share

Is the Housing Market About to Cool or Crash?Is the Housing Market About to Cool or Crash?

The Federal Reserve has set its sights on taming inflation, with the 30-year mortgage rate currently hovering around a hefty 7%. Their weapon of choice? Raising interest rates. This has sent…

Share