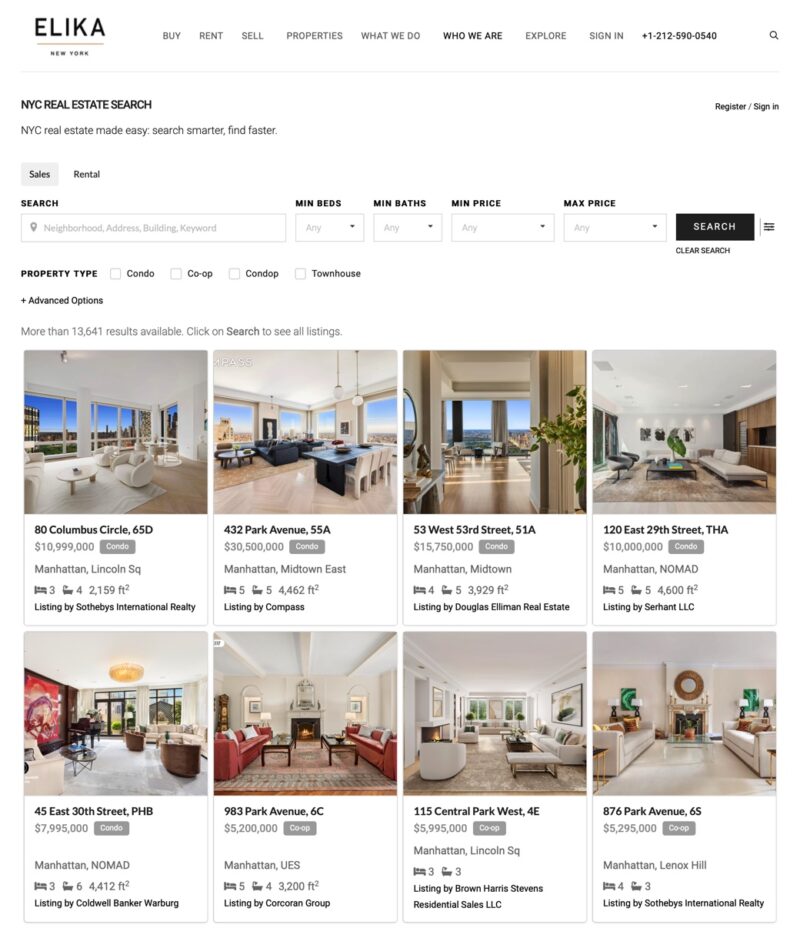

If you’ve been paying attention, you’ll know that the NYC housing market is a fully-fledged buyer’s market. As a result, sellers have slowly concluded that they must reduce asking prices to stay competitive. Unfortunately, with the current and future glut in inventory, they have little choice other than to take their properties off the market.

But if you’re looking to buy during this golden opportunity, there might be a better option than trying to haggle a seller down to their final offer. Rather than just focusing on the sales price, you should also negotiate closing costs. Sellers tend to be far more open to concessions such as these than steep price cuts alone.

However, not all closing costs are fair game for negotiation. For example, it would be considered unreasonable for a buyer to expect a seller to pay their application fee, just as it would be for a seller to ask a buyer to pay their move-out fee. The type and condition of the property for sale will also determine how open the seller is to concessions.

Closing costs that are the most open for negotiationClosing costs that are the most open for negotiation

Negotiating the most available closing costs are the flip taxes and transfer taxes. In a hot market, sellers will aim to make buyers pay these. In a slow market, as we have now, it’s the other way around.

Look at new developments for the most concessions.Look at new developments for the most concessions.

The best opportunity for reducing closing costs is with new developments. The reason is that with so many new condo developments on the rise, developers are eager to get inventory into a contract. However, they don’t want to reduce their asking price. With an oversupply of inventory and fewer buyers in the market to compete with, savvy buyers can negotiate for concessions.

The first one to aim for is the transfer tax, which stands at 1.425% of the purchase price (for properties priced at $500,000 or over). In a resale transaction, this fee is usually covered by the seller. But a new development purchase switches to the buyer’s responsibility. In the current market, with new developments struggling, developers are more willing to take up this charge, especially on the luxury side.

Don’t overlook the NYS transfer tax, which is $4 per $1,000 of the purchase price. Some sponsors are willing to cover months or years in common charges. With things as they are now, other smaller fees are potentially up for negotiation. These include the working capital fund contribution, the cost to cover the buyer’s share of the resident managers’ unit, and the sponsor’s attorney fees.

Negotiate for closing creditsNegotiate for closing credits

Instead of negotiating for price reductions, negotiate for closing credits. This money can then pay off some of your remaining closing costs. For example, consider the difference between a $10,000 reduction in the sales price and $10,000 in closing credits.

The reduction in the sales price will only offset your mortgage payments by a slight margin. But the closing credits mean $10,000 less you’ll have to draw out of your bank account at closing.