Table of Contents Show

Few other real estate markets are as expensive, competitive, or complex as New York City. For these reasons, many buyers with the funds to do so often opt for the all-cash buying process. By paying the total cost of a home upfront, buyers can circumvent much of the cost, time, and uncertainty that comes with the mortgage financing process. However, even when you do have enough cash lying around to contemplate this choice, it’s not always the best one you can make.

Before paying all cash for a home purchase, ensure you understand the pros and cons of the process.

What Does It Mean to Buy a Home “All-Cash”?What Does It Mean to Buy a Home “All-Cash”?

Anyone with all the money they need to buy a property is an all-cash buyer.

The funds typically come from savings, investments, selling another property, or other sources. Interestingly, there’s nothing technically illegal about showing up for the closing with a suitcase full of physical cash. There are no laws prohibiting this. However, in practice, it’s seldom done due to the complications it would cause for the seller.

For this reason, cash transactions are usually conducted through a bank-to-bank wire transfer. Doing it this way is easier for everyone involved and won’t raise eyebrows for the IRS or the bank about where the money came from. You can also write a personal check though it’s more common to use a cashier’s check instead.

The Process for Buying a Home All-CashThe Process for Buying a Home All-Cash

The home buying process for an all-cash transaction is the same as a financed transaction, except you skip the mortgage process.

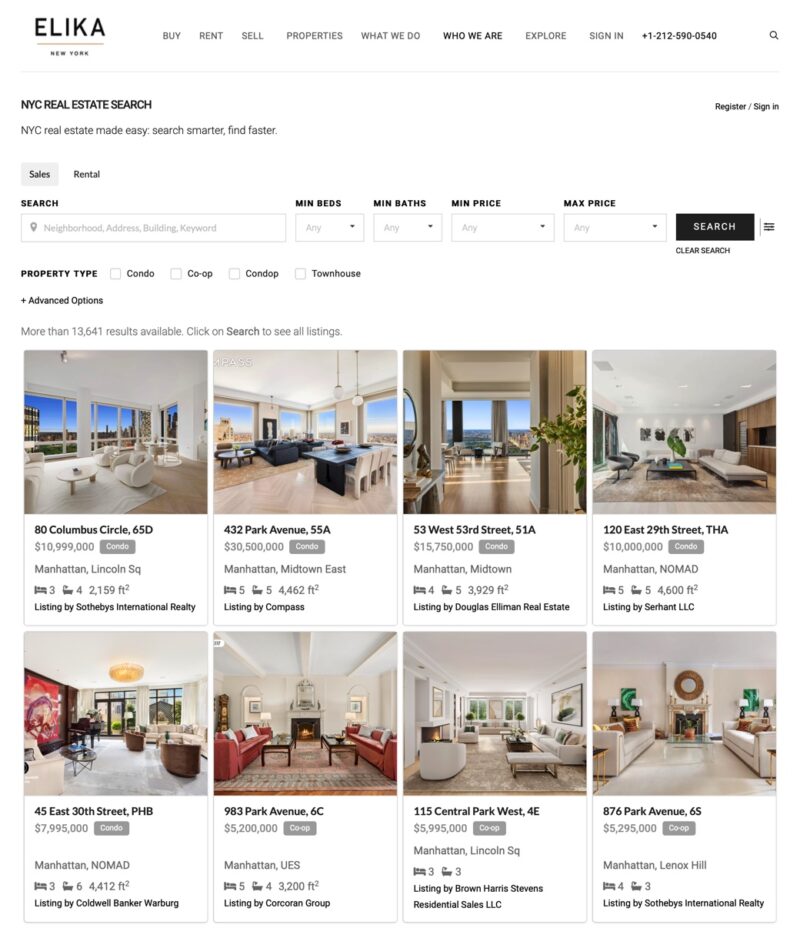

You’ll still need to review all the available listings that catch your eye, assessing them on their price, location, number of bedrooms, and building amenities. Once you’ve found one that ticks all (or most) of the boxes, you will make an offer that will hopefully be accepted. After you’ve paid the deposit, next comes the attorney’s due diligence period to assess whether the property has any potential issues, such as structural problems or unpaid liens. Assuming everything checks out, your attorney can now schedule a closing day with the seller. You will pay the remaining balance and receive the keys to your new home.

Co-op sales can take longer as you still need to go through the board application process. The whole process can be done in a few weeks. That said, it’s better to plan for about 45-60 days to close as the building still needs to interview you and approve your sale. In addition, having the cash to pay for the purchase is not enough in the case of a co-op that looks for at least 1-3 years of post-closing liquidity and future earnings.

Buying a Home All-Cash: Pros and ConsBuying a Home All-Cash: Pros and Cons

ProsPros

- Deal Certainty – One of the biggest reasons sellers love cash buyers is the certainty they bring to the deal. A lot can go wrong with a mortgage application that can lead to a loan rejection or a low appraisal that causes the deal to fall apart. With an all-cash transaction, the sellers need not worry about any of that, making your offer far more attractive than a financed deal.

- Seller Saves Money – A loan application can add about a month to the buying process. The longer the deal takes, the more the seller must pay for carrying costs such as property taxes, mortgage interest, and building fees. Paying cash means the process moves faster, saving the seller money and increasing the size of your offer.

- Lower Closing Costs – While most of your closing costs will remain the same, not getting a mortgage means you can avoid those related to the loan application. The biggest of these is the mortgage recording tax which is 1.8% on loan amounts under $500,000 and 1.925% on amounts above $500,000.

- No Interest – A mortgage means paying back a chunk of what you borrowed each month and interest on the loan. Paying all cash allows you to avoid these interest payments and any other fees related to a mortgage.

ConsCons

- Your Money is Tied Up – Real estate is considered an illiquid asset, meaning it cannot be easily or readily converted into cash without a substantial loss in value. Putting a large portion of your liquid assets into a property makes it more difficult to find the money for other things in your life. It can sometimes make more financial sense to buy with a mortgage, but with a sizeable down payment to keep your monthly loan payments low.

- No Mortgage Tax Deductions – While paying for a mortgage each month can be a pain, it does come with the benefit of tax deductions on the first $750,000 of your mortgage. This lowers your taxable income.

Can I Buy a Home with Cash and Still Get a Mortgage Later?Can I Buy a Home with Cash and Still Get a Mortgage Later?

In a market where cash is king, it can be difficult for buyers with tight pockets to compete against all-cash offers, which usually results in higher prices for those who finance. One way around this is delayed financing, which allows you to buy a home with cash and then obtain a mortgage later. This tends to work well for buyers who have the cash necessary for purchase but don’t want to overextend their finances.

When you apply, your lender will want to ask a few questions about why you want to refinance when you already own the property outright. As with any mortgage application, you’ll also need to undergo the underwriting process to ensure you can keep up with your future mortgage payments.

Final ThoughtsFinal Thoughts

An all-cash offer is one of the most effective ways to secure a home purchase in NYC’s highly competitive market.

However, you must be certain your finances can stretch enough to afford it. Buyers considering making an all-cash offer are advised to seek consultation from their CPA or a financial advisor to ensure they understand all the pros and cons of their situation.